Price Difference Accounting in Odoo 16 (AVCO/FIFO Method)

This blog gives you an overview of Price Difference accounting in the Odoo 16.

Definition of Price Difference accounting:

Whenever we generate the purchase order of some amount (e.g.; 100$) and create a bill of a different amount than the purchase order (e.g.;80$), the difference amount will be called the ‘Price Difference Account’.

How to activate the Price Difference Account?

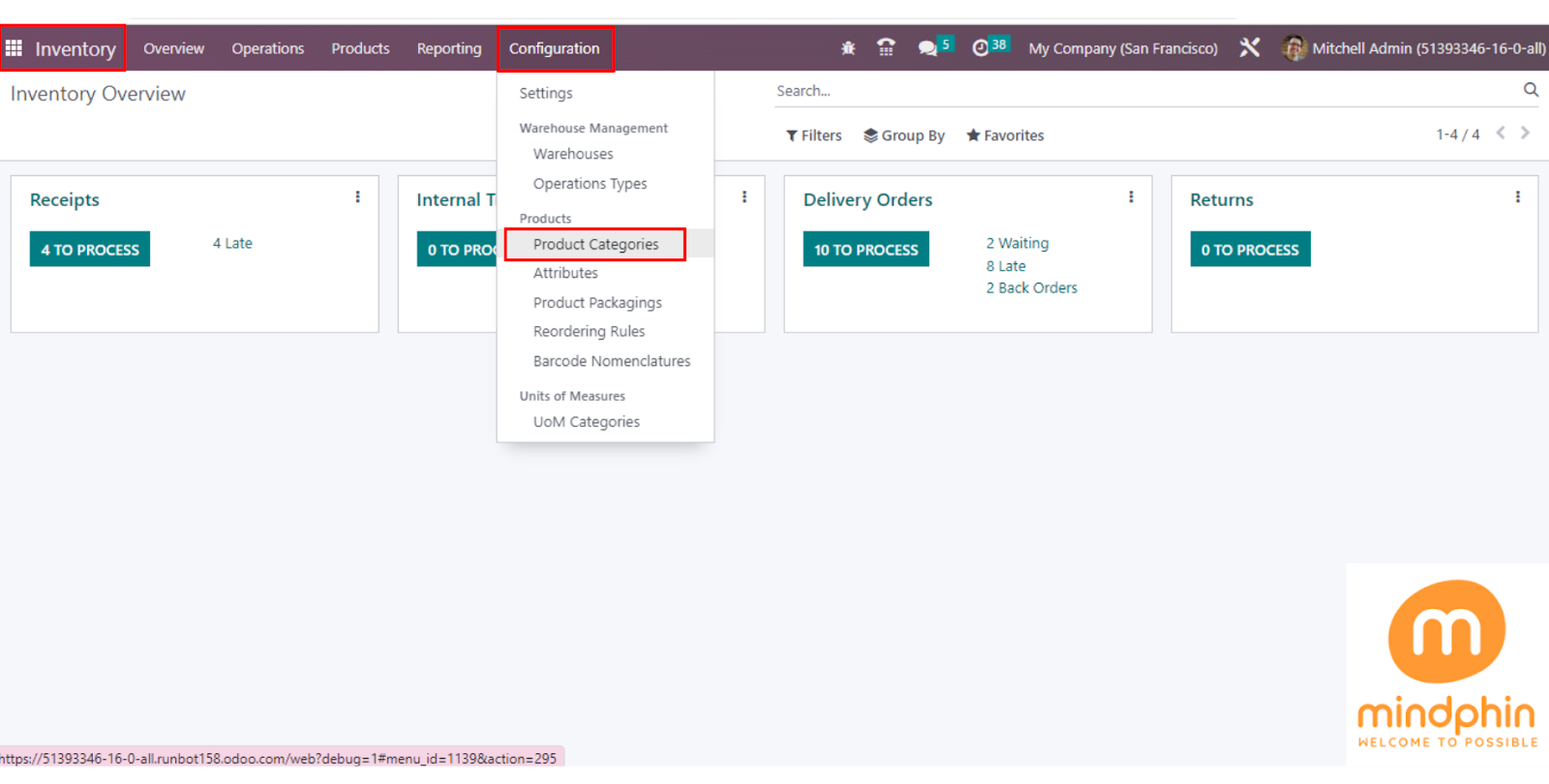

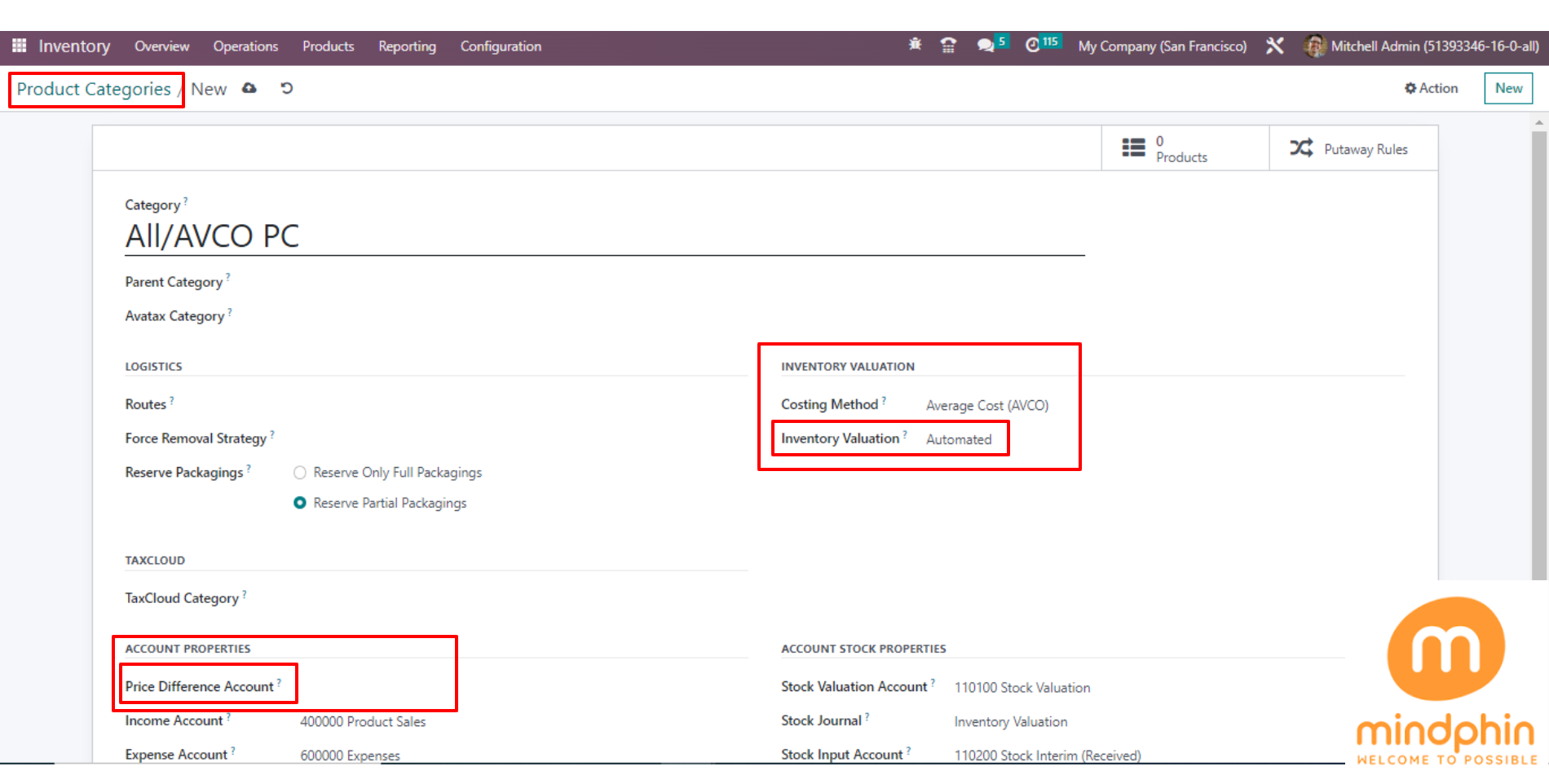

Inventory Application > Configuration > Product Categories > Inventory Valuation > Set as ‘Automated’ > In the ‘Account Properties’ Price Difference Account will be activated.

-> In the product category, you need to set the ‘Automated’ option for the Inventory valuation.

How many costing methods are there?

- First In First Out (FIFO)

- Average Cost (AVCO)

- Standard Price

In Odoo 16 where the price difference will be posted directly on the journal “ Stock” in AVCO and FIFO (Automated) methods.

But, as per the Standard behavior of Odoo 16, there's no need to set the ‘Price Difference account’ in AVCO and FIFO methods. The price difference account will only work with ‘Standard price’ (automated and costing method).

‘Price Difference account’ will be activated through the Inventory Application > Configuration > Product Categories.

Now, you have to select the Product category and define all the configurations.

Also, when we set Inventory Valuation as “Automated” then only the “Price Difference Accounting” option will be enabled. (If you have set “Manual” then it will not show the Price Difference Account option)

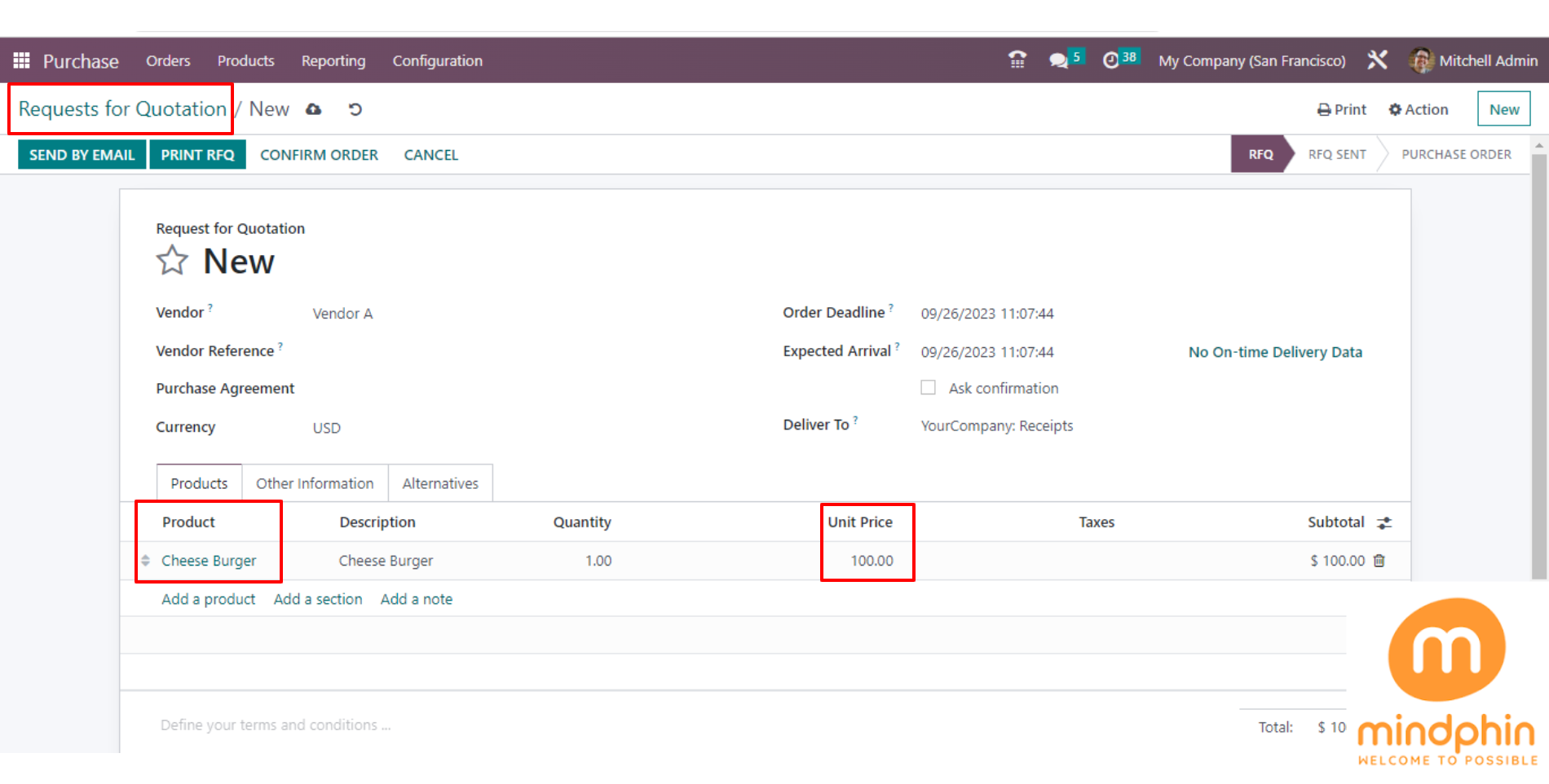

Now, Create a New ‘Request For Quotation(RFQ)’ of some amount and validate it. When we create a new PO then it will generate a journal entry.

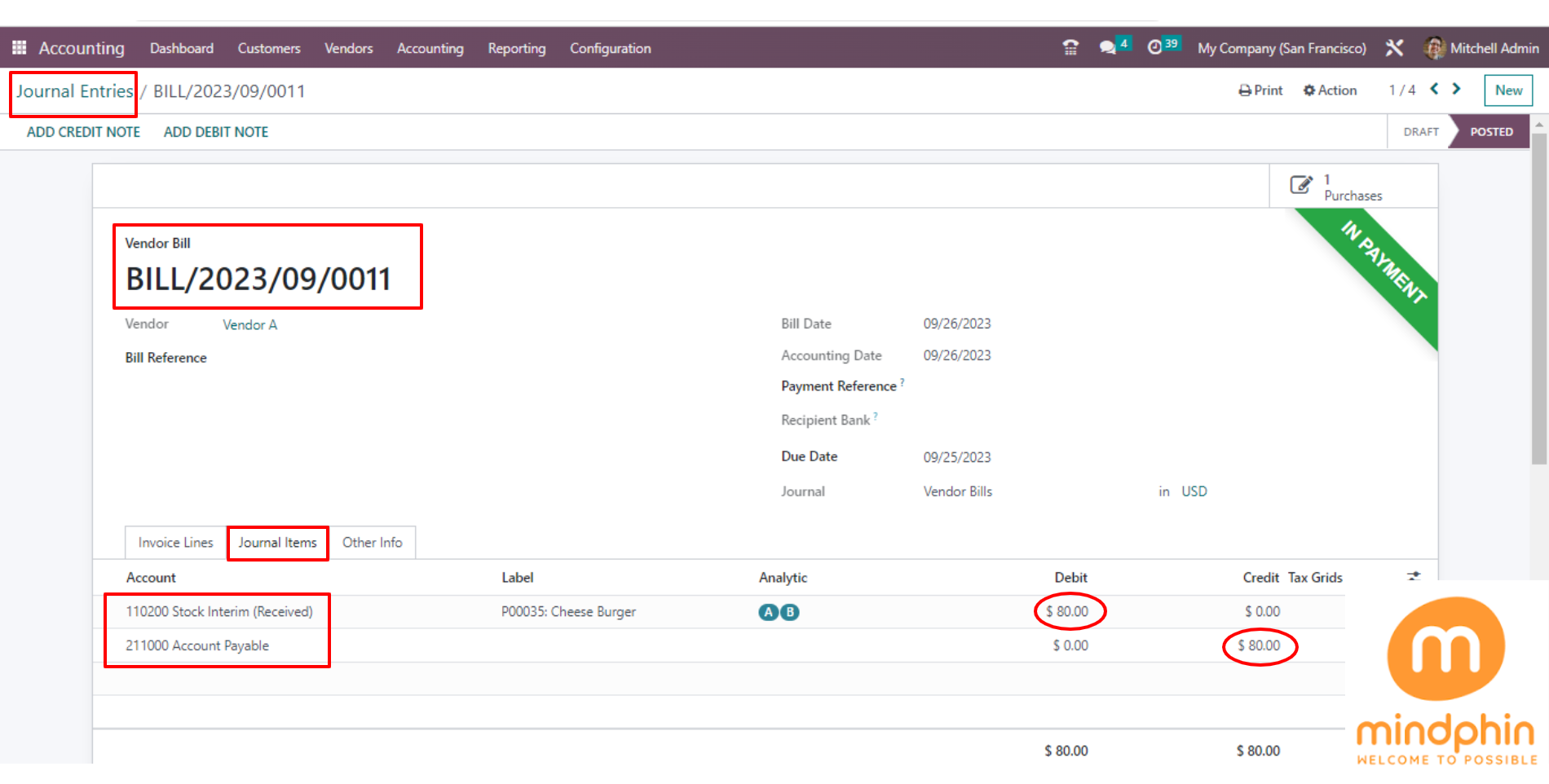

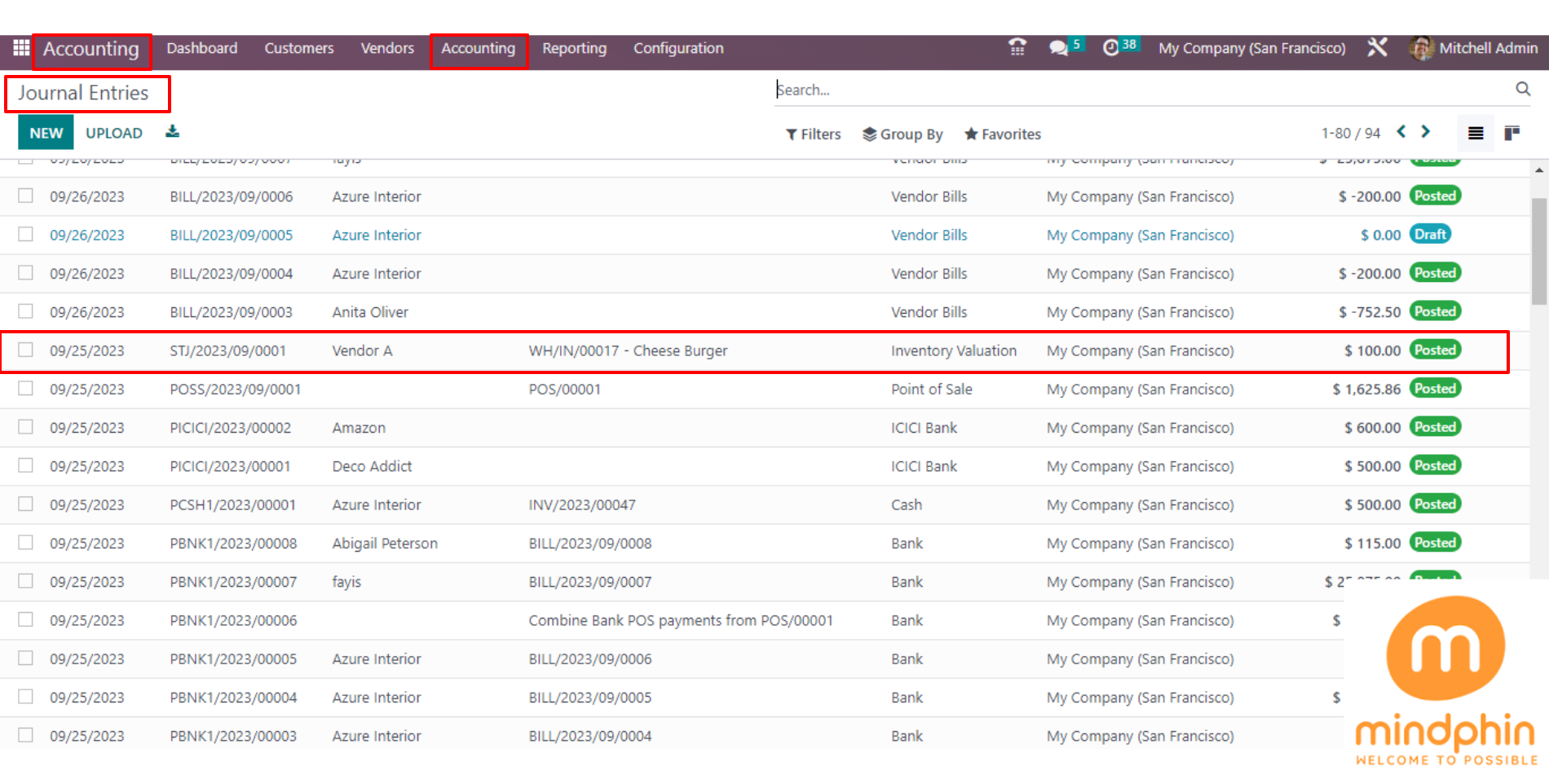

Here, you can see the Created Journal Entry through Accounting Application > Accounting > Journal Entries.

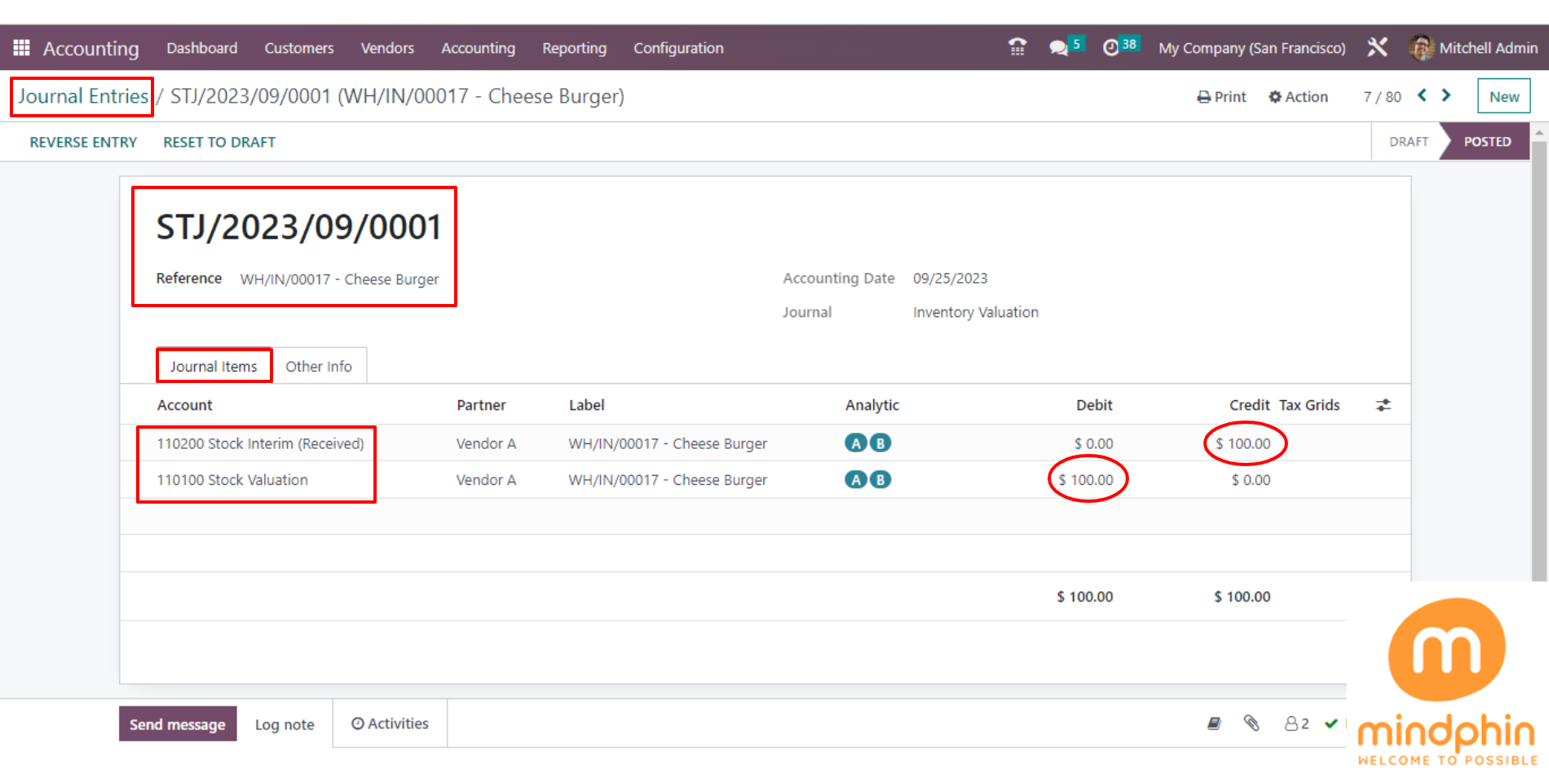

When you open that generated Journal entry here, you can see the Accounts and Amount of ‘Debit’ which are Stock Valuation Accounts, and ‘Credit’ which are Stock Interim (Received) Accounts.

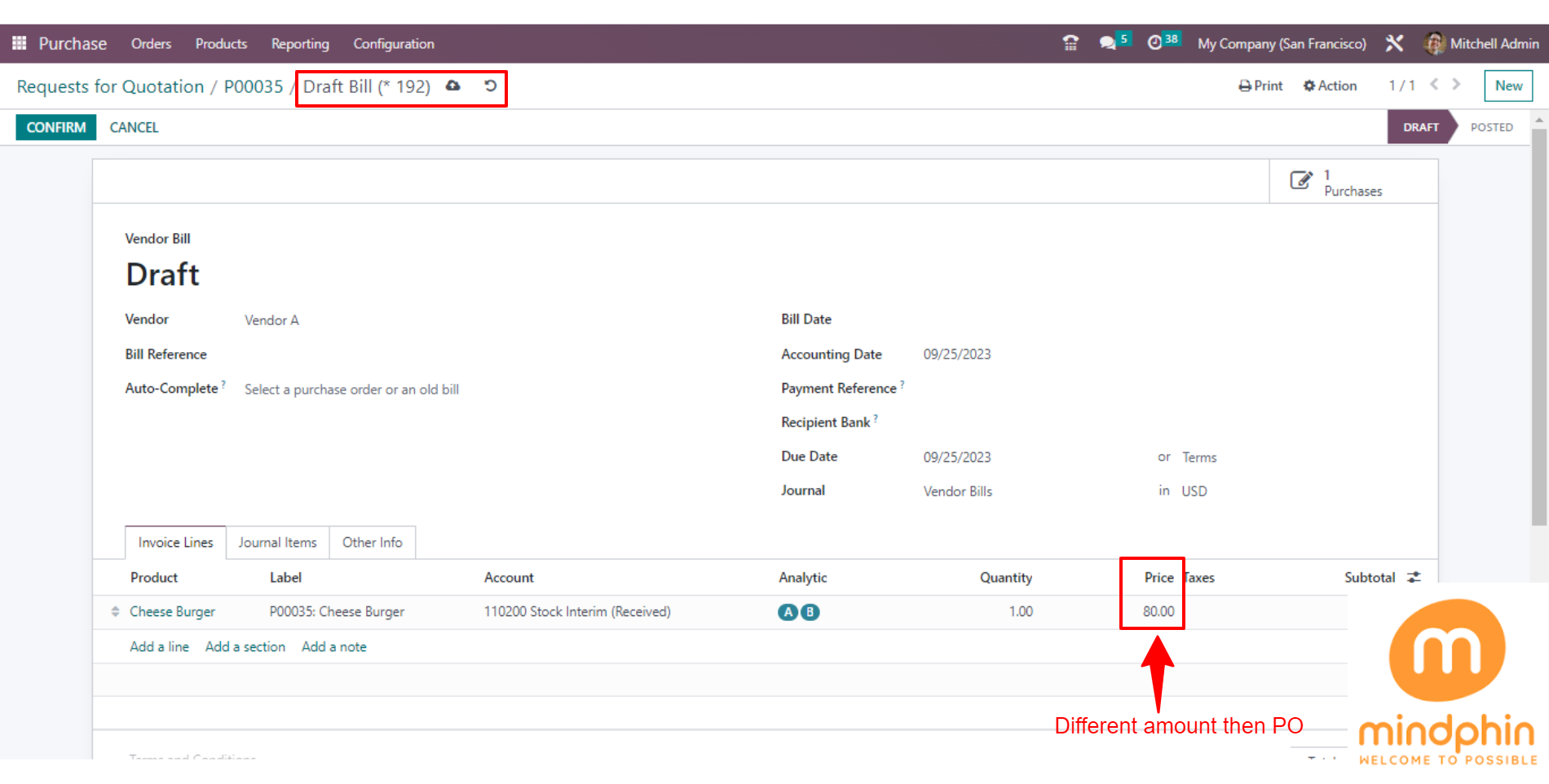

Now the next step is to Create a Bill and then put the ‘different amount/price’ than the Purchase order and then click on Save.

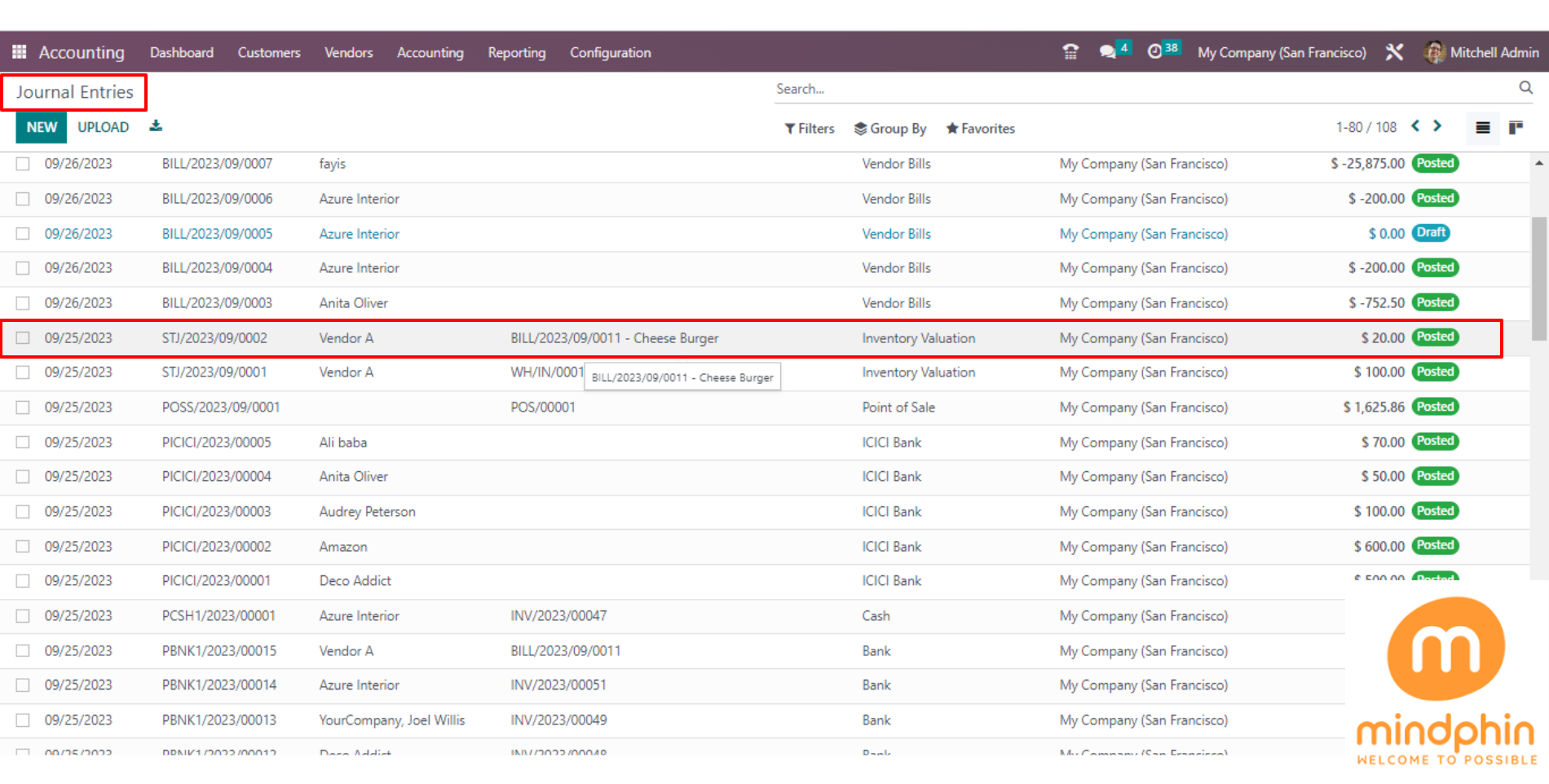

Now here, you can see the difference amount’s entry will be generated in the journal entries

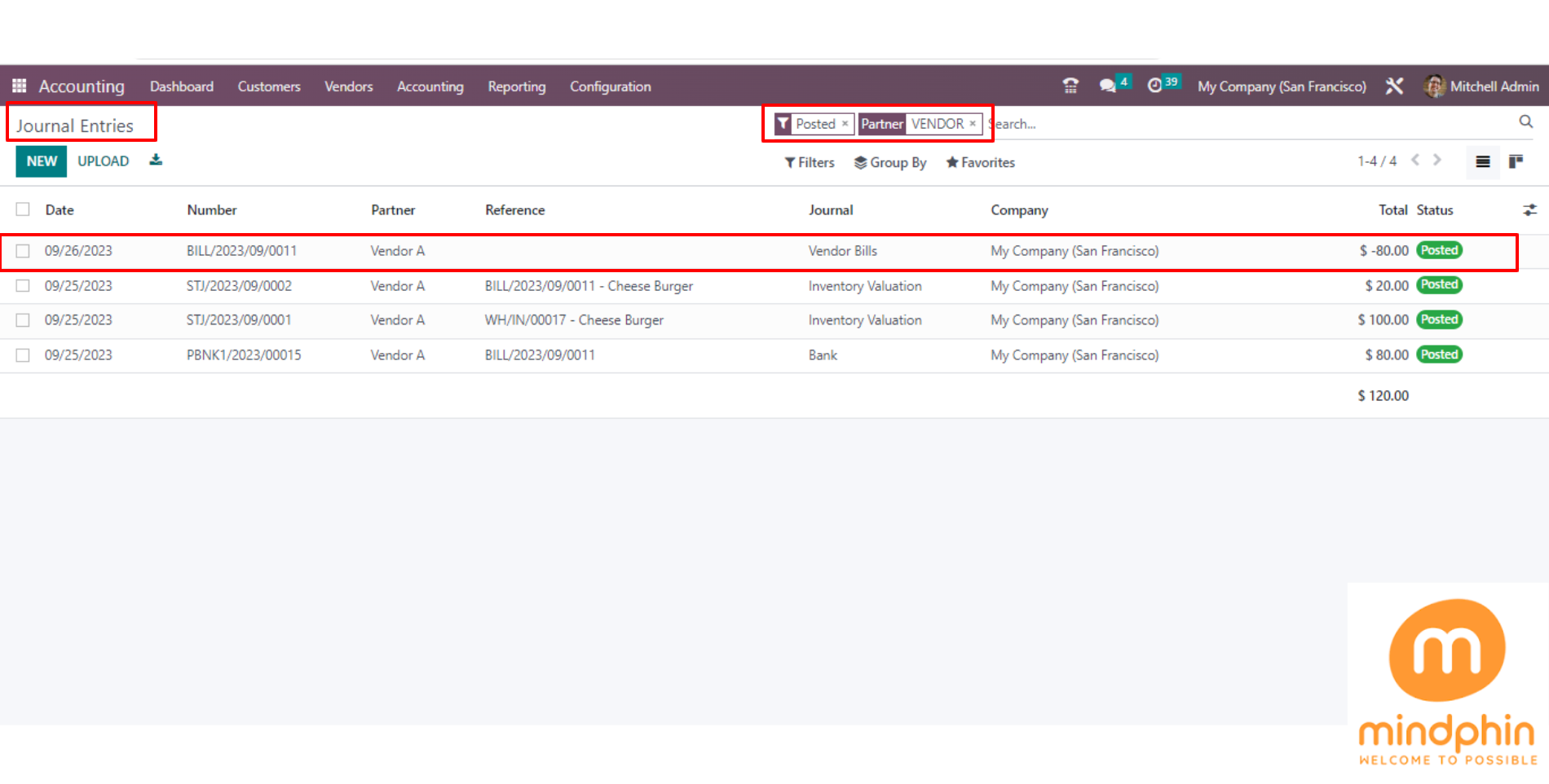

Here, in the Journal Entries when the filter set as ‘Posted’ and you can search as the Partner then you’ll see the remaining amount entry in (-).

When you open that generated Journal entry here, you can see the Accounts and Amount of ‘Debit’ which are Stock Interim (Received) Accounts, and ‘Credit’ which are Account Payable Accounts.