This blog gives you an overview of Fiscal positions in the Odoo 16 Accounting module.

Overview of Fiscal Position In Odoo

In fiscal positions, you can define rules that automatically adjust taxes and accounts for your transactions. The process can be Automated, Manual, or Partner-specific.

In the Fiscal Position, New transactions can be created on the fly by setting default taxes and accounts on products and customers. Different taxes and accounts may be required depending on the localization and type of business of the customers and providers.

Configuration:

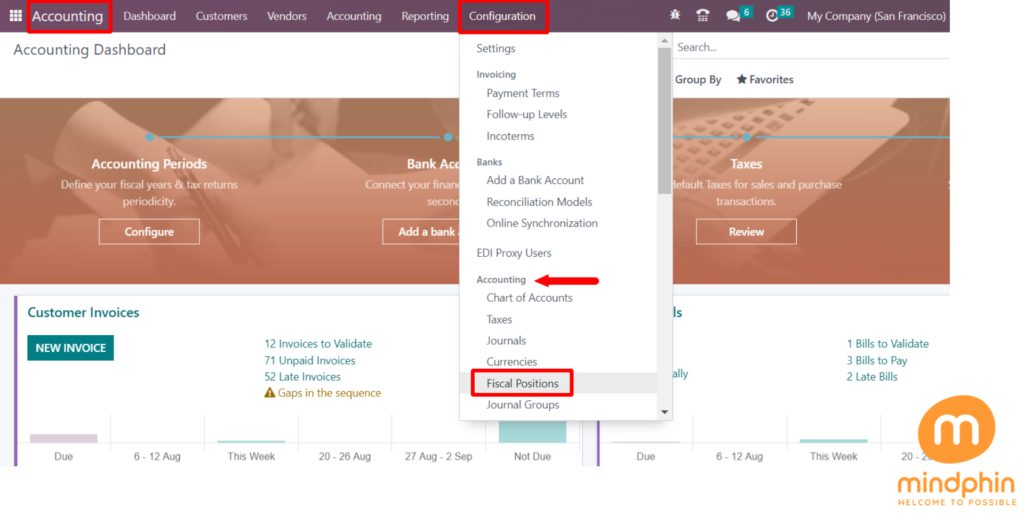

Go to Accounting App > Configuration > Fiscal Positions (Accounting), you can edit or create a fiscal position.

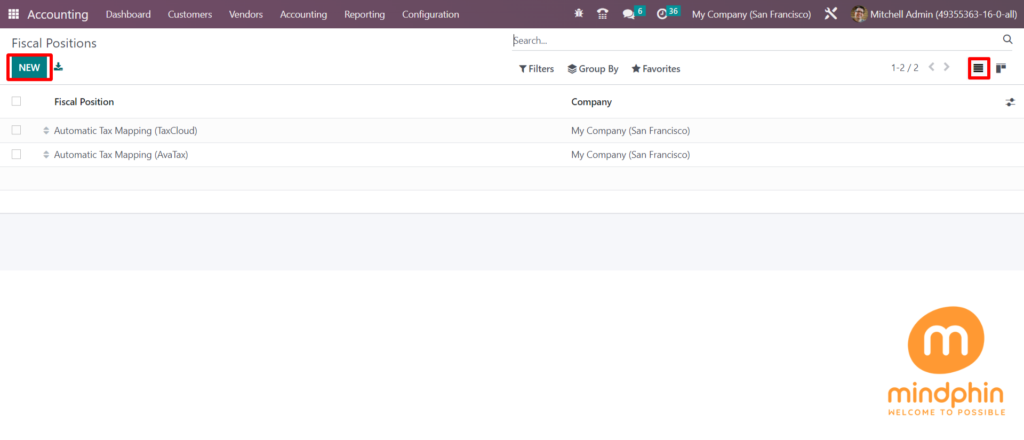

In the Fiscal Position, to open the entry or to create a new fiscal position click on New.The Fiscal Positions window shows all fiscal positions created by the user. Detailed information such as the Fiscal position and the Company can be acquired by users.

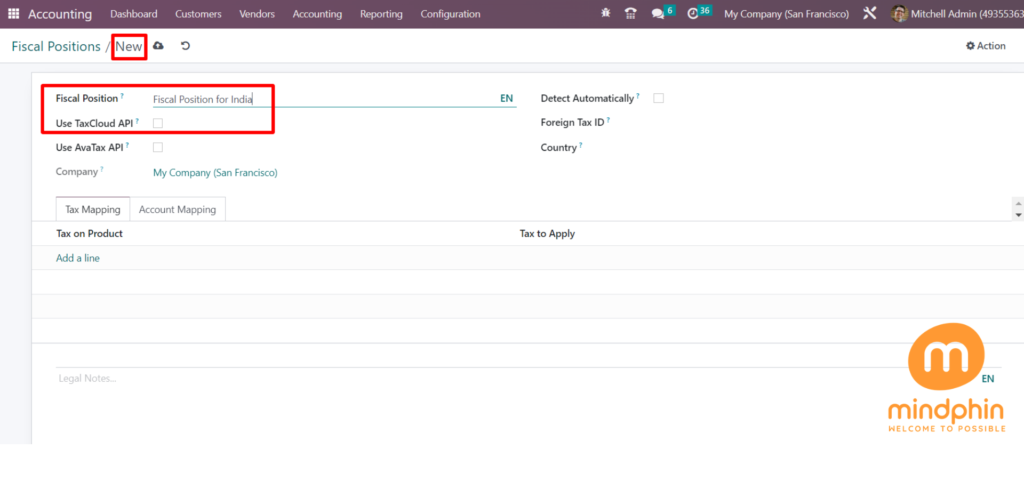

After clicking on the New button add the name of Fiscal Position as Fiscal Position for India.

From there, several conditions can be activated:

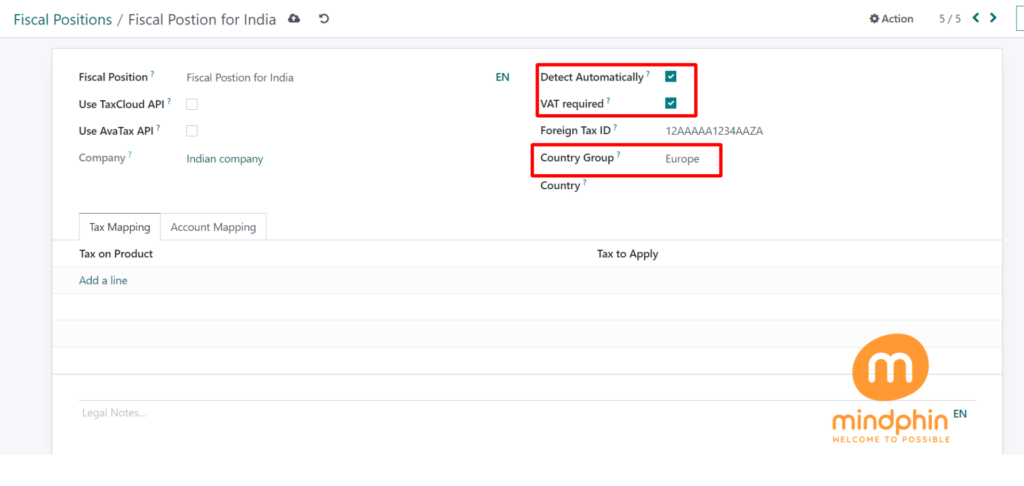

- VAT Required: the customer’s VAT number must be present on their contact form.

- Country Group and Country: the fiscal position is only applied to the selected country or country group.

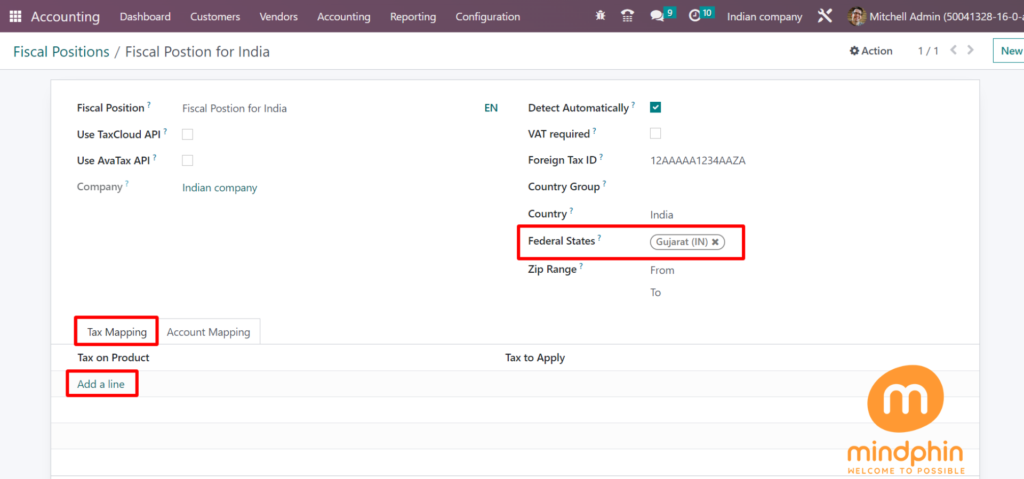

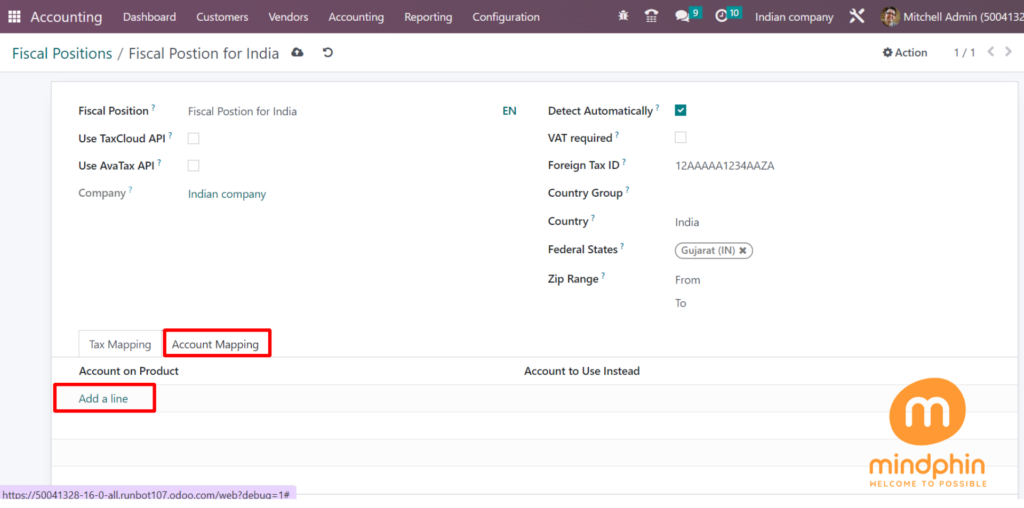

To automatically apply a fiscal position following a set of conditions, go to Accounting > Configuration > Fiscal Positions, open the fiscal position to modify, and tick Detect Automatically.

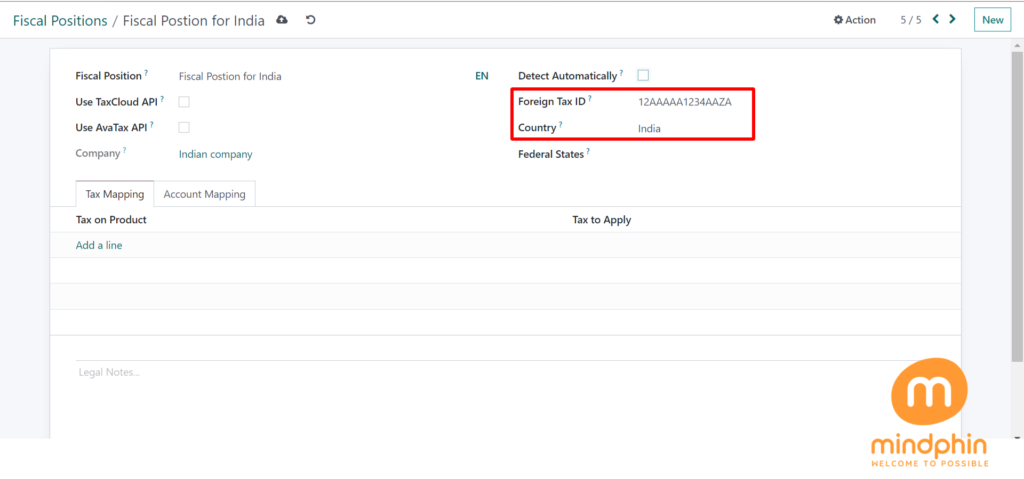

Inside the Foreign TAX ID Field, mention the company’s TAX ID region mapped to Fiscal Position. In addition, Select India as the Country.

The Federal States Field should contain the state regarding the Indian Country.Using the Add a line menu inside the Tax Mapping tab, users can specify the tax on products.

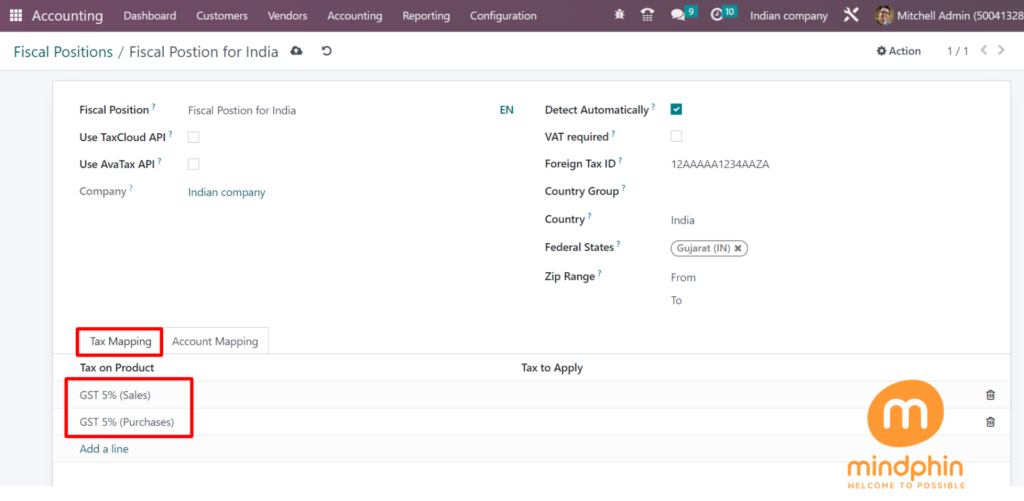

A product tax that is mapped to another tax can be created in the open space. After selecting the Add a line option, you can set the tax on a product, known as Tax on Product. It is possible for users to select a default tax option or create a custom one based on their fiscal situation.

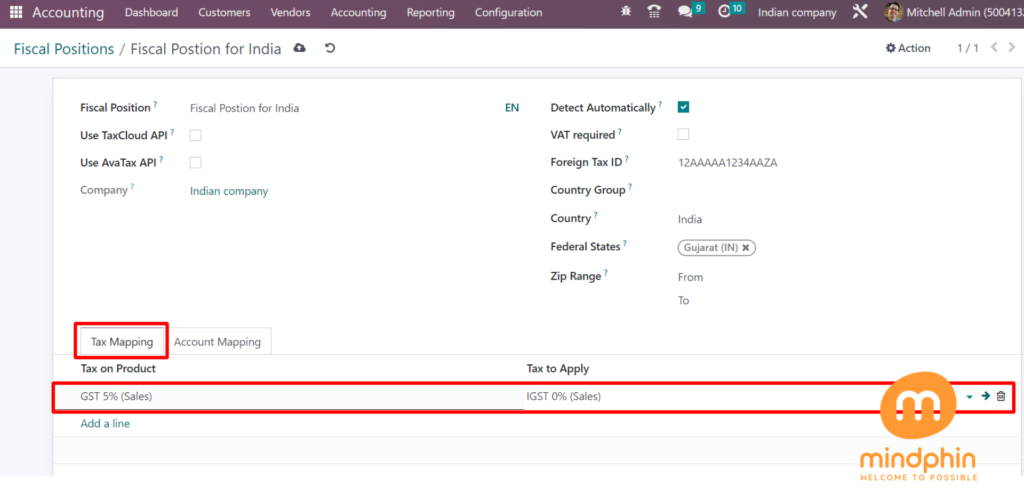

As shown in the screenshot above, we can access the default Tax on Product options. Below the Tax Mapping tab, we selected IGST 0% (Sales) as the tax to apply.

By Clicking on Add a line option below the Accounting Mapping Section, Users can apply for the an account on the product

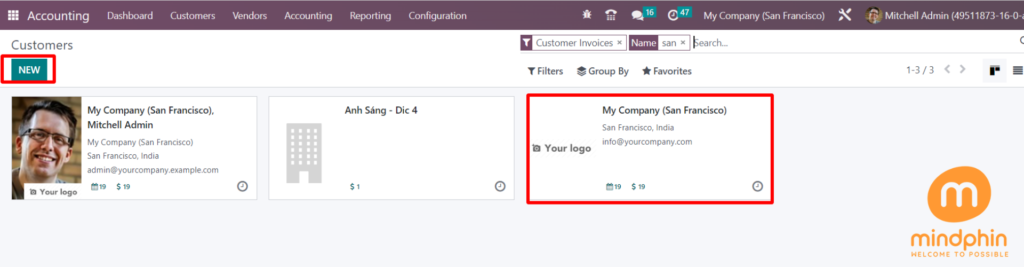

Ensure the fiscal position data is saved after entering essential details. Now, let’s see how to set a fiscal position on a customer invoice in the Odoo 16 Accounting. To begin with, we will need to apply a fiscal position to customer data in Odoo 16. Users can access all created partners through the Customers menu. The NEW Button in the Customers window allows you to create new customer information.

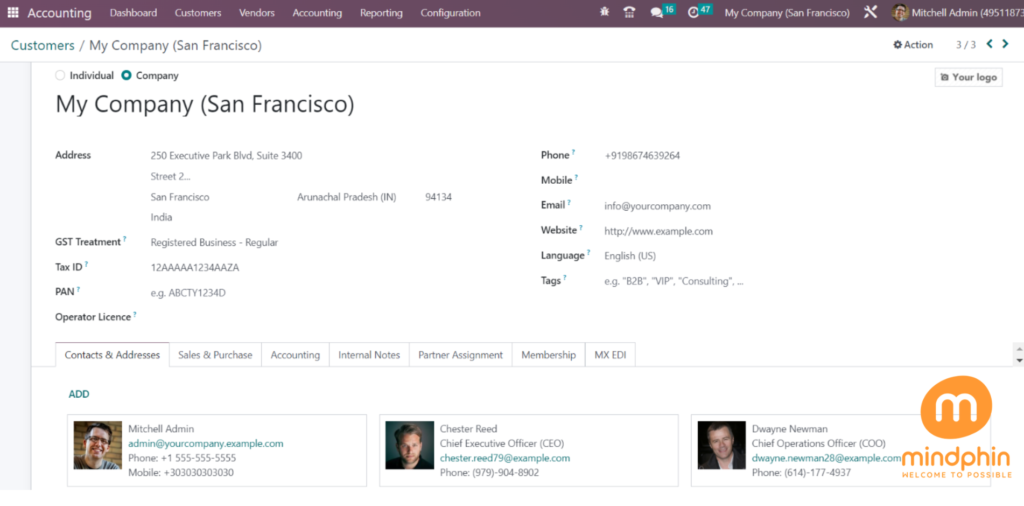

As shown in the screenshot above, we can select My Company(San Francisco) from the Customer’s window. On the new page, we can identify the company’s phone number, address, website and email address.

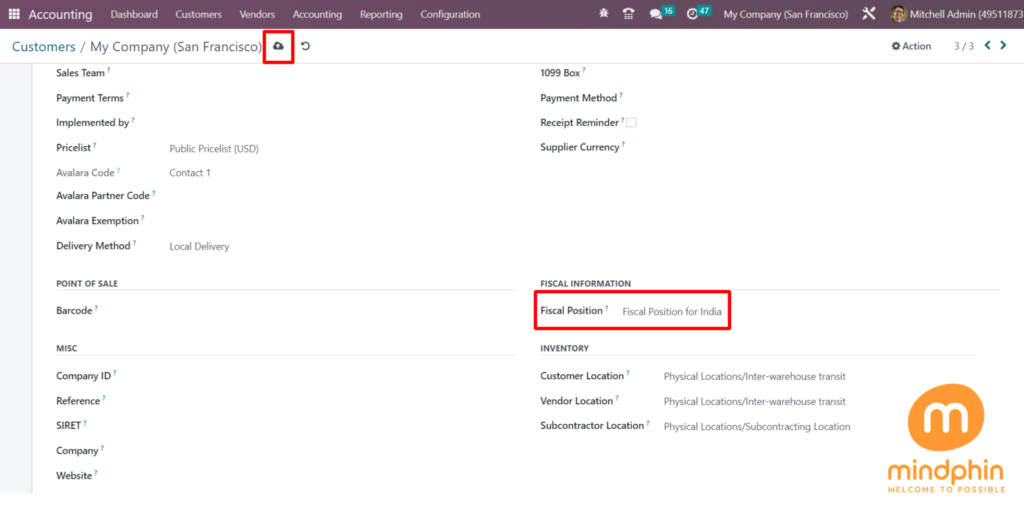

THE FISCAL INFORMATION section is below the Sales & Purchase tab. We can select the Fiscal Position for India from the kist within the fiscal position section.

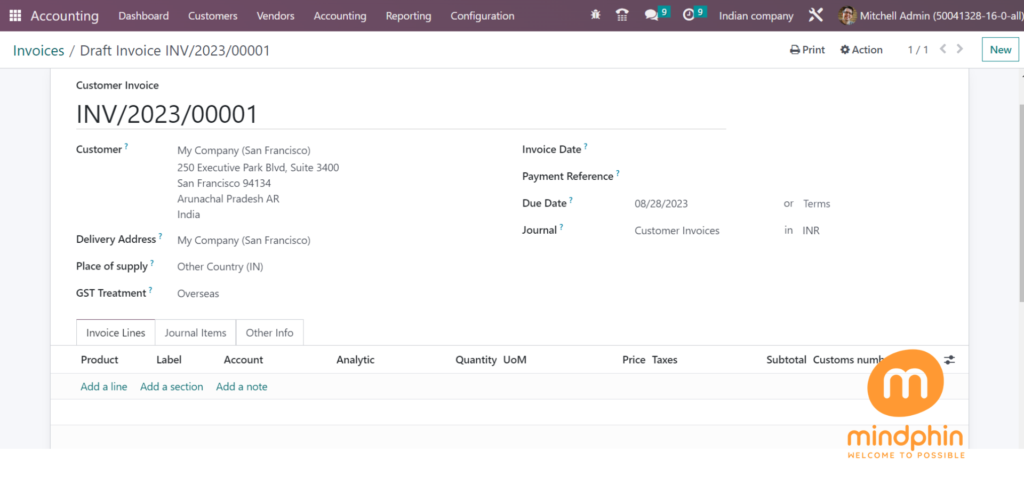

Creating a new invoice can be achieved by pressing the CREATE button in the Customers window. The Delivery Address will be automatically displayed when the Customer is selected as a My Company(San Francisco).

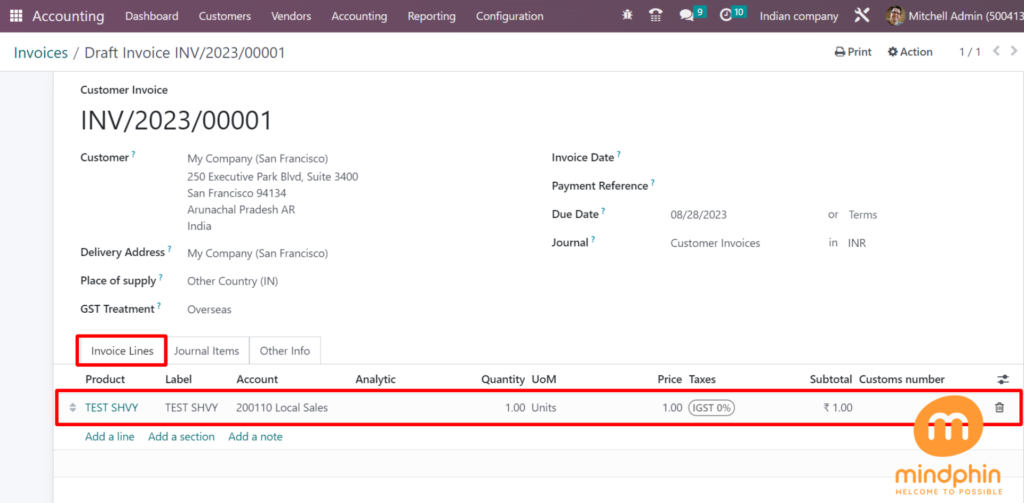

In the Invoice Lines tab, we select the TEST SHVY inside the Product title. Users can also pick other products by selecting Add a line.as demonstrated in the screenshot below.

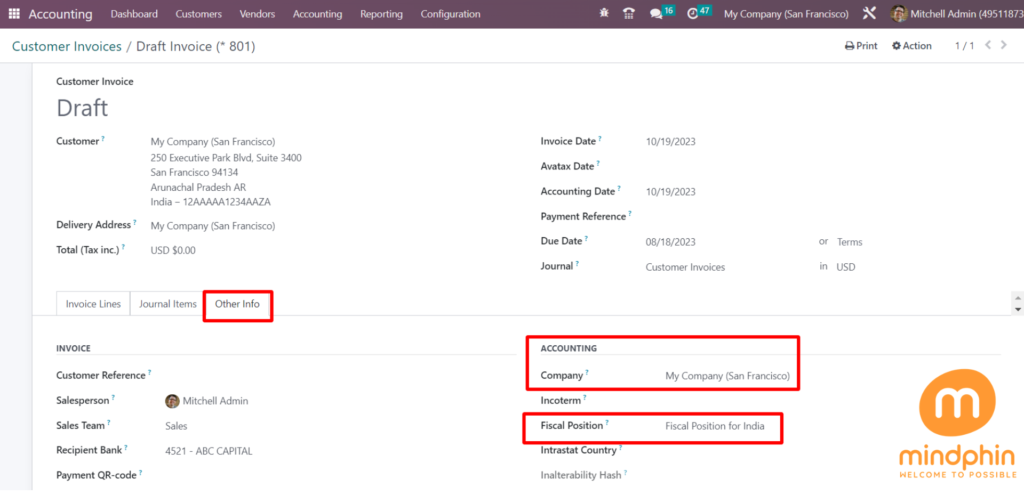

After selecting My Company(San Francisco). As a Customer in Odoo 16 Accounting, we have automatically applied the Fiscal Position for India after selecting the Accounting tab inside the ACCOUNTING section.

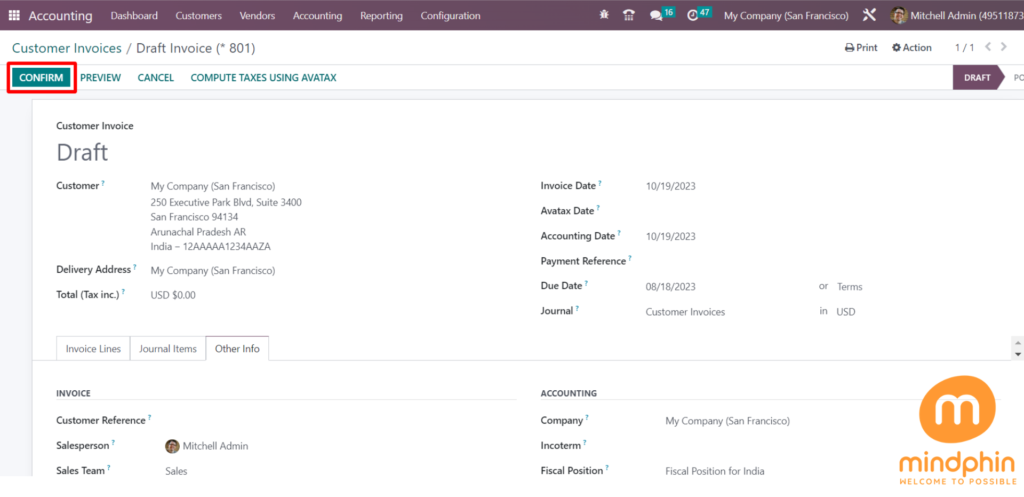

Now, we can verify the order by clicking on the CONFIRM icon in the Invoices window.

Hence, a fiscal position can be processed within an invoice created for a customer in Odoo 16 Accounting after confirmation in the Invoices window.

Odoo ERP allows users to manage fiscal positions based on a specific country, and users can generate different customer invoices according to their business requirements. Maintaining a fiscal position in different countries of a company can lead to tremendous growth in a business.

TAGS: ODOO, ODOO DEVELOPMENT