Storno Accounting in Odoo 16: A Detailed Overview

What is Storno Accounting in Odoo 16?

Use negative debits and credits to reverse original accounting entries by activating the Storno Accounting setting.

Accounting rule: Debit what comes in (+), credit what goes out (-)

Odoo 16 has introduced a new feature called ''Storno accounting'', which is designed to handle reverse entries by representing them as negative credits or debits. In the realm of business operations, there are numerous scenarios that necessitate reversals. When manual journal entries are made, errors can creep in, such as incorrect amounts, taxes, accounts, or dates, prompting the need for corrections through reversals. For example, the reversal of invoices through credit notes and refunds are common instances of reverse journal entries that require attention. In such cases, Storno accounting steps in to accurately reflect the credit and debit values as negative, ensuring proper accounting practices.

Storno Accounting, a method widely used in Eastern European nations, is a mandatory practice in countries like China, Czech Republic, Croatia, Poland, Romania, Russia, Serbia, Slovakia, Ukraine, and more.Storno accounting is a popular method used to reverse journal entries with negative debits and credits in order to prevent duplicate figures in the accounting system. Reversals may occur due to various reasons, such as identifying errors in the initial transaction or processing refunds for returned items. Bookkeepers typically use red ink to document Storno entries, hence the method is also referred to as Red Storno. The financial reports will highlight these entries in red for easy identification.

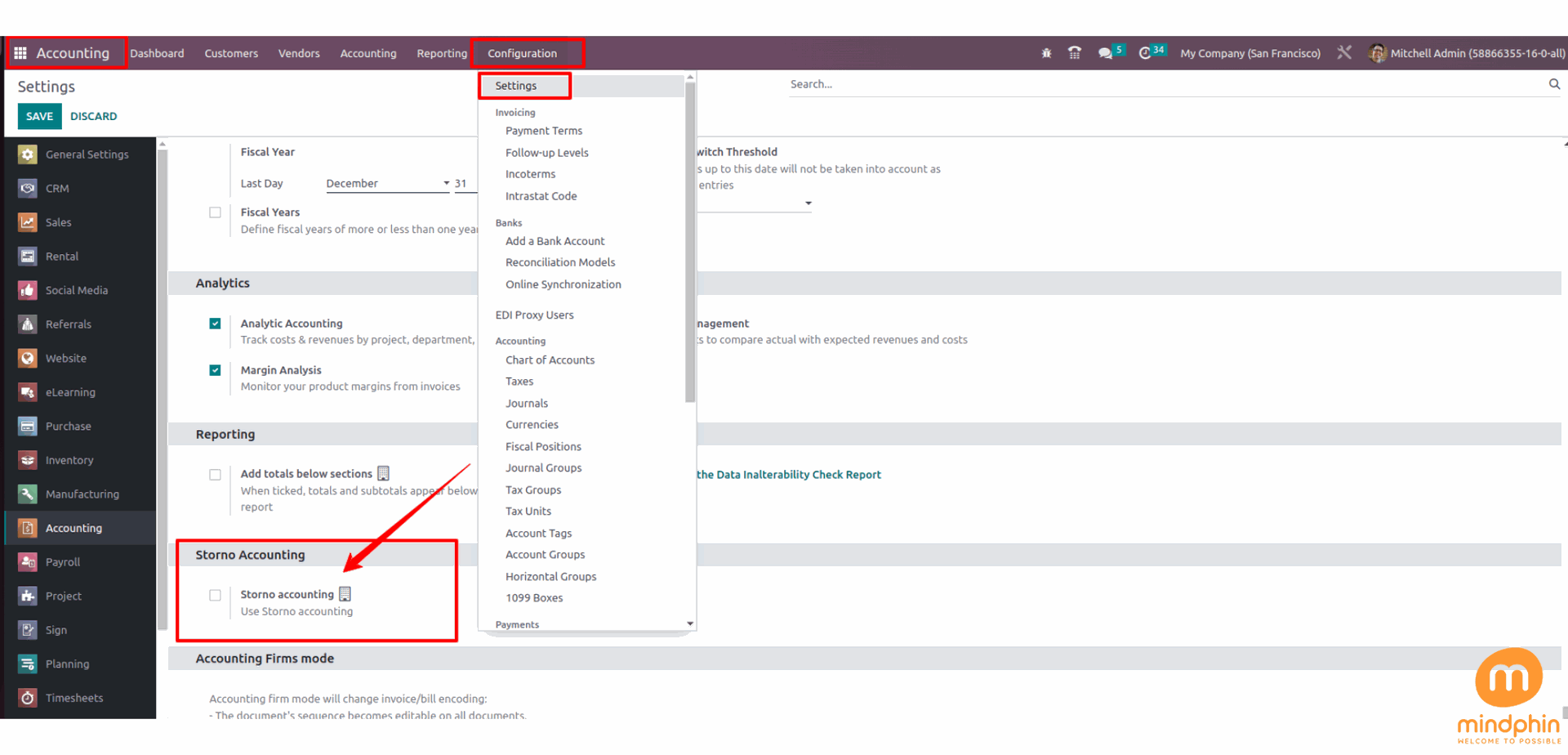

Let's see how the storno accounting is configured in odoo 16 Accounting. For the Go to Accounting Application > Configuration > Settings > Enable Storno Accounting.

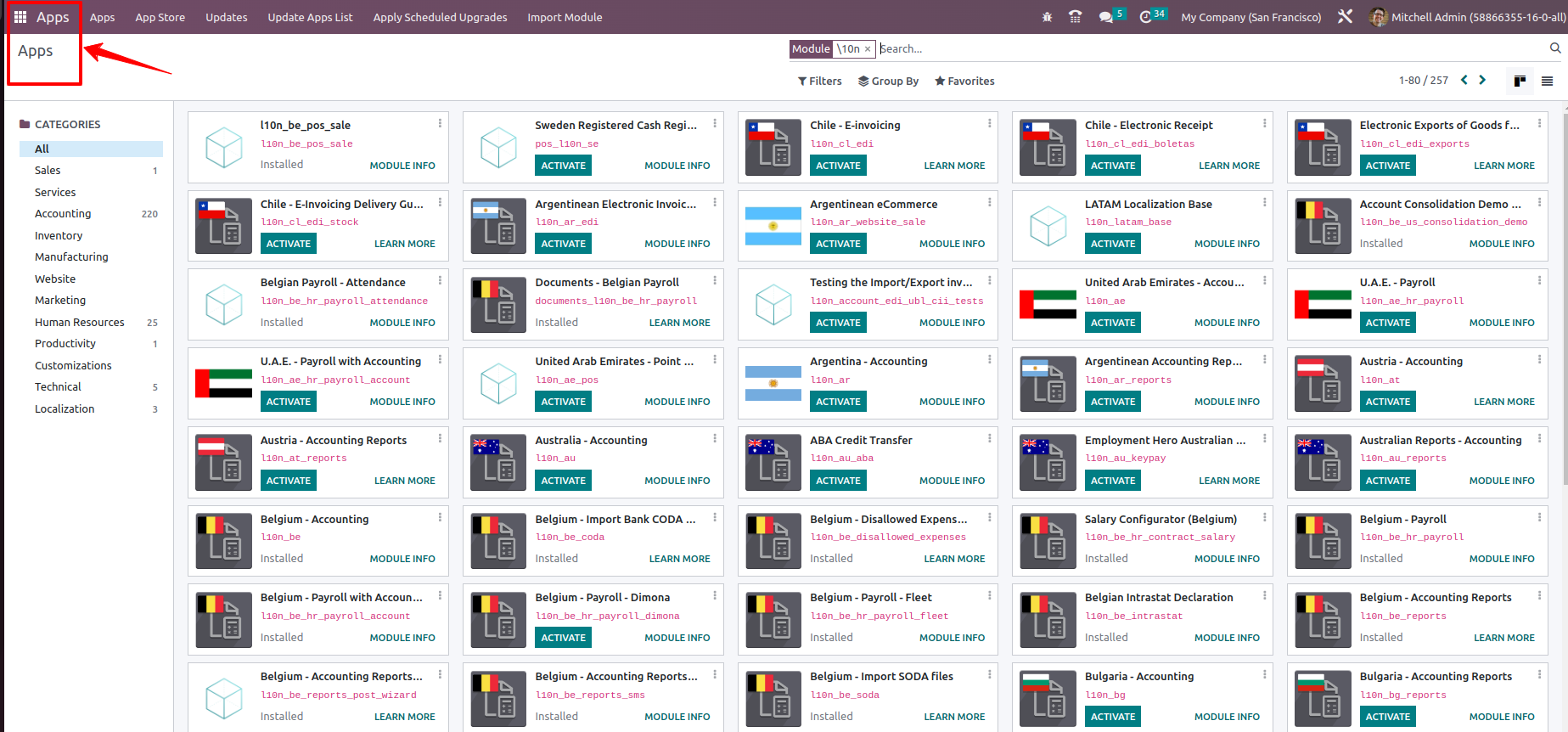

By enabling 'Storno Accounting', Odoo Accounting gains access to storno accounting functionality in Odoo 16. Odoo offers various Fiscal localization packages to support accounting operations in different countries. These localization packages can be easily found by searching in the Odoo Apps store.

Now, let's analyze the impact of these entries on the ledgers. Let's consider a scenario where a sales return is initiated. The reversal amount is then documented as a negative credit and debit. These negative credits/debits have implications for both accounting journal entries and stock journal entries, as the reversal process encompasses stock reversals.

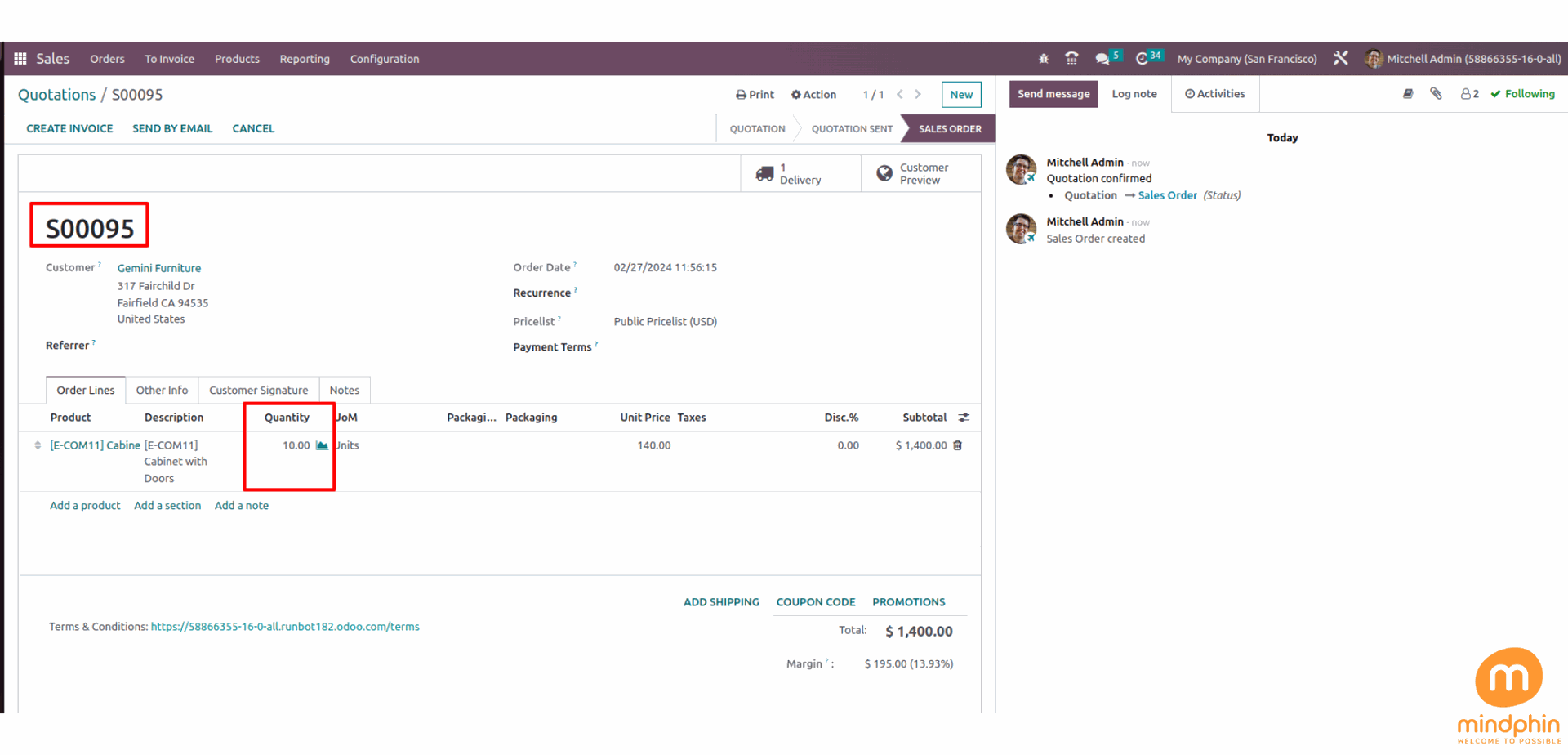

Make a sales order for a product, with customers requesting 10 units.

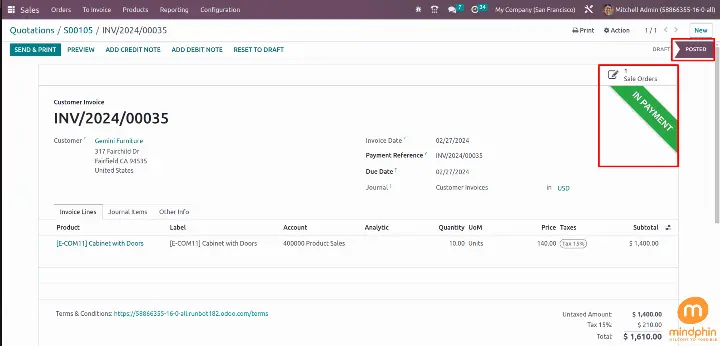

Now, we can proceed to send the invoice to the customer as per our invoicing policy. Once the invoice is sent, we will assume that the customer has already made the payment.

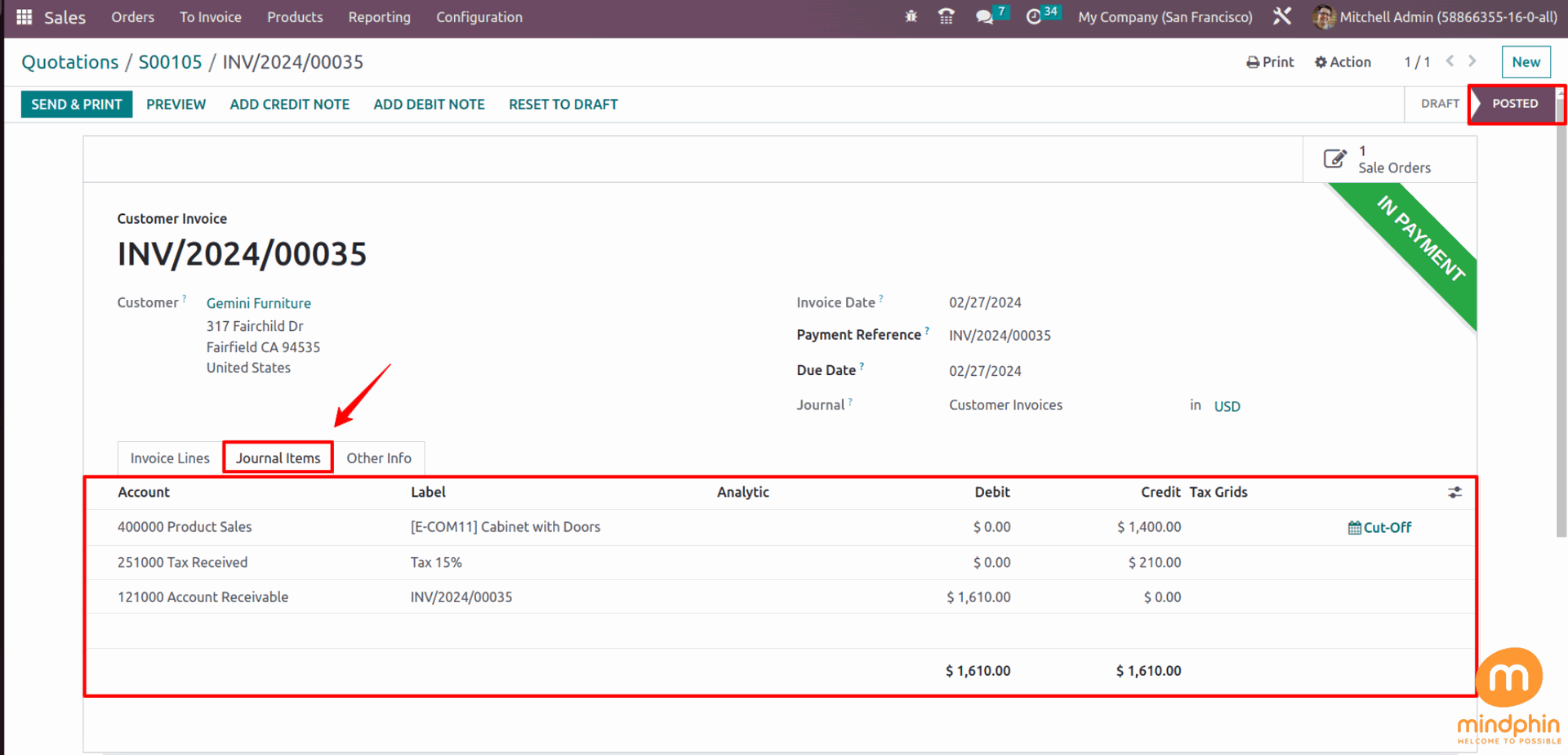

Within the journal Items tab, we can observe the ledger entries for the relevant accounts.

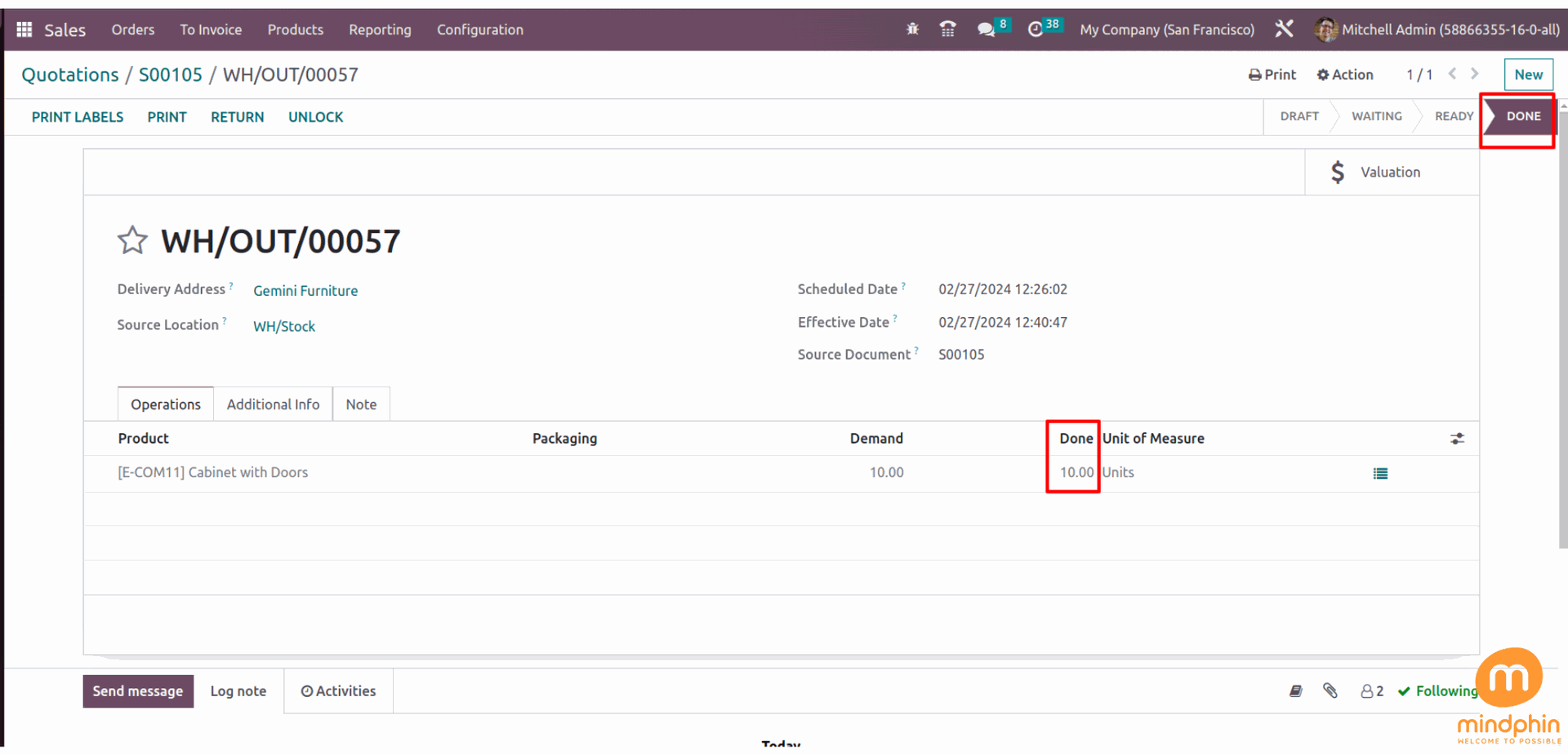

As requested by the customer, a delivery of 10 items has been made to the customer.

To view the stock journal entries related to the delivery, we debit the stock valuation account and credit the stock output account.

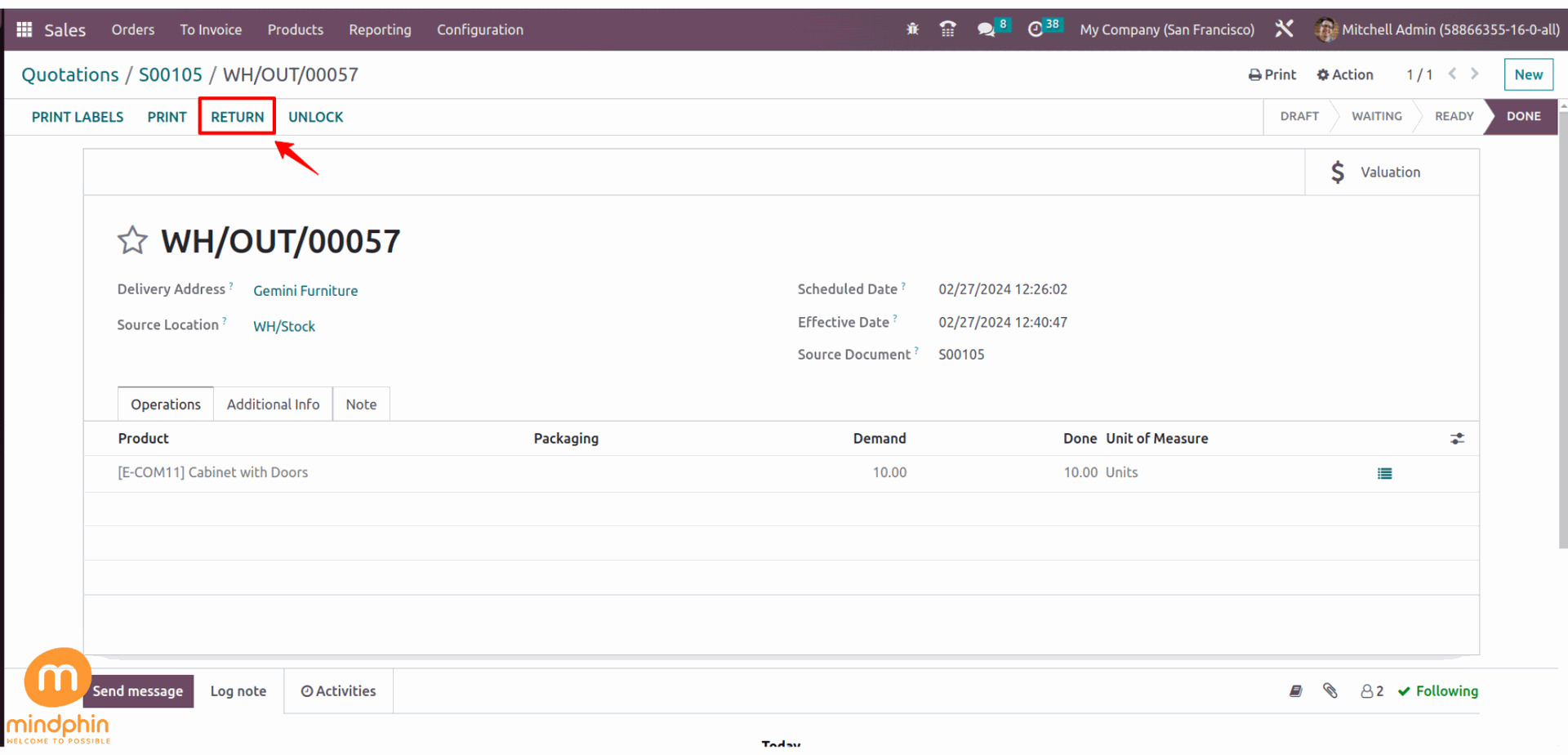

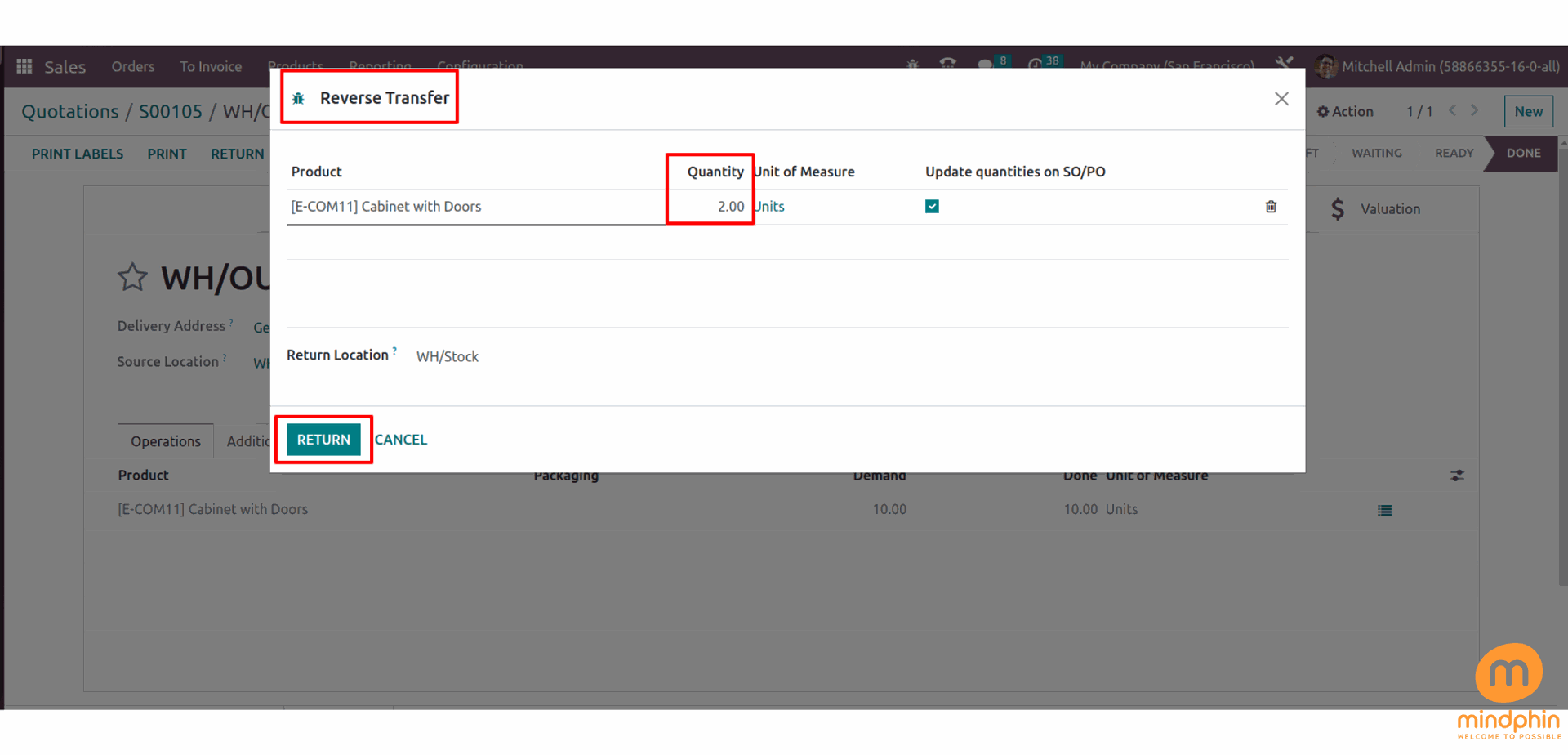

Let's say the customer discovers that 2 units of Cabinet with doors are defective. In this case, they have the option to return the faulty products to the company.

If you wish to return an item, simply click on the return option. A dialog box will appear, allowing you to specify the quantity being returned by the customer. For instance, if 2 units are being returned, enter 2 and then press 'RETURN'.

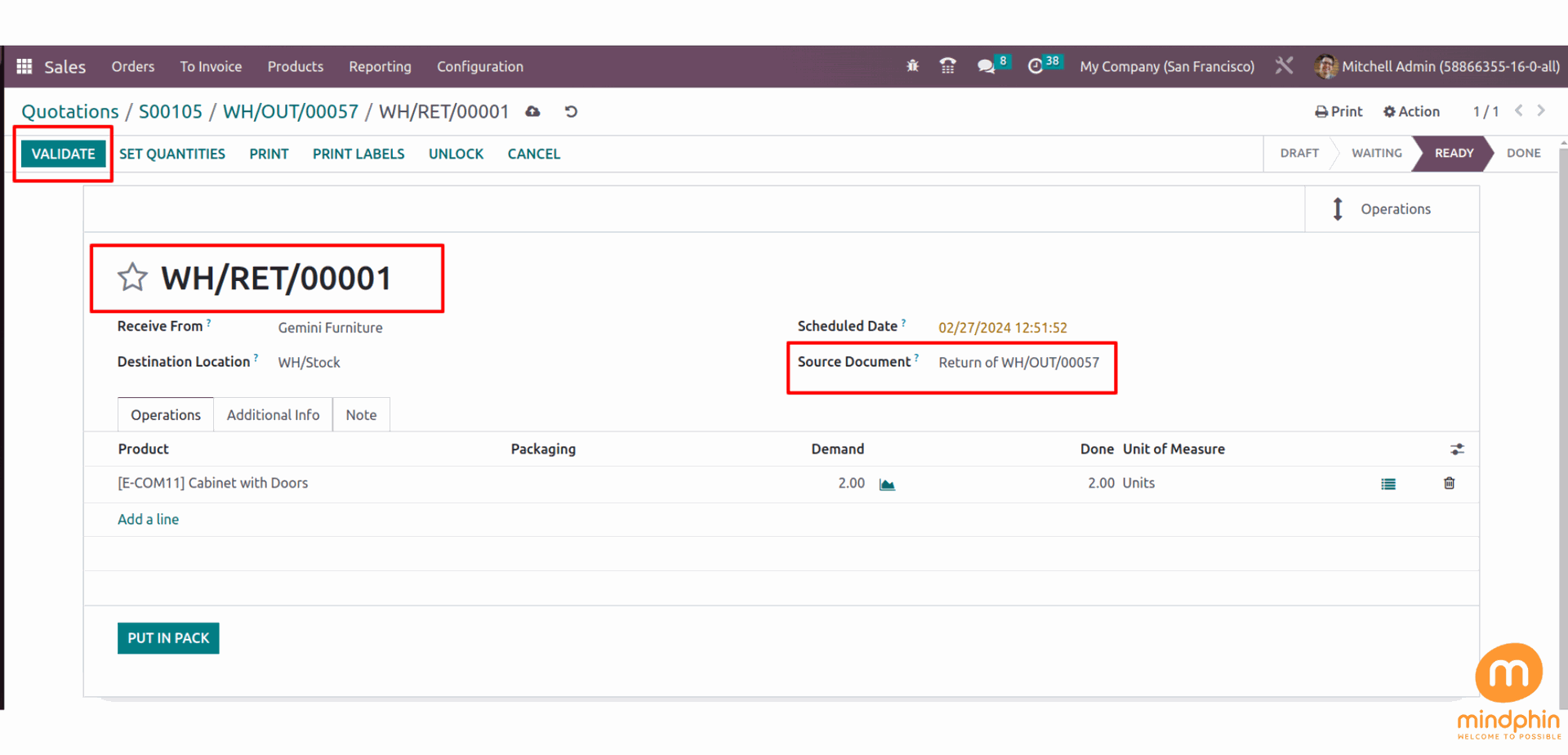

Executing a return transfer and confirming the return.

The values impacted in the stock interim delivery are recorded as debits instead of credits, and the stock valuation is documented as credits rather than debits.

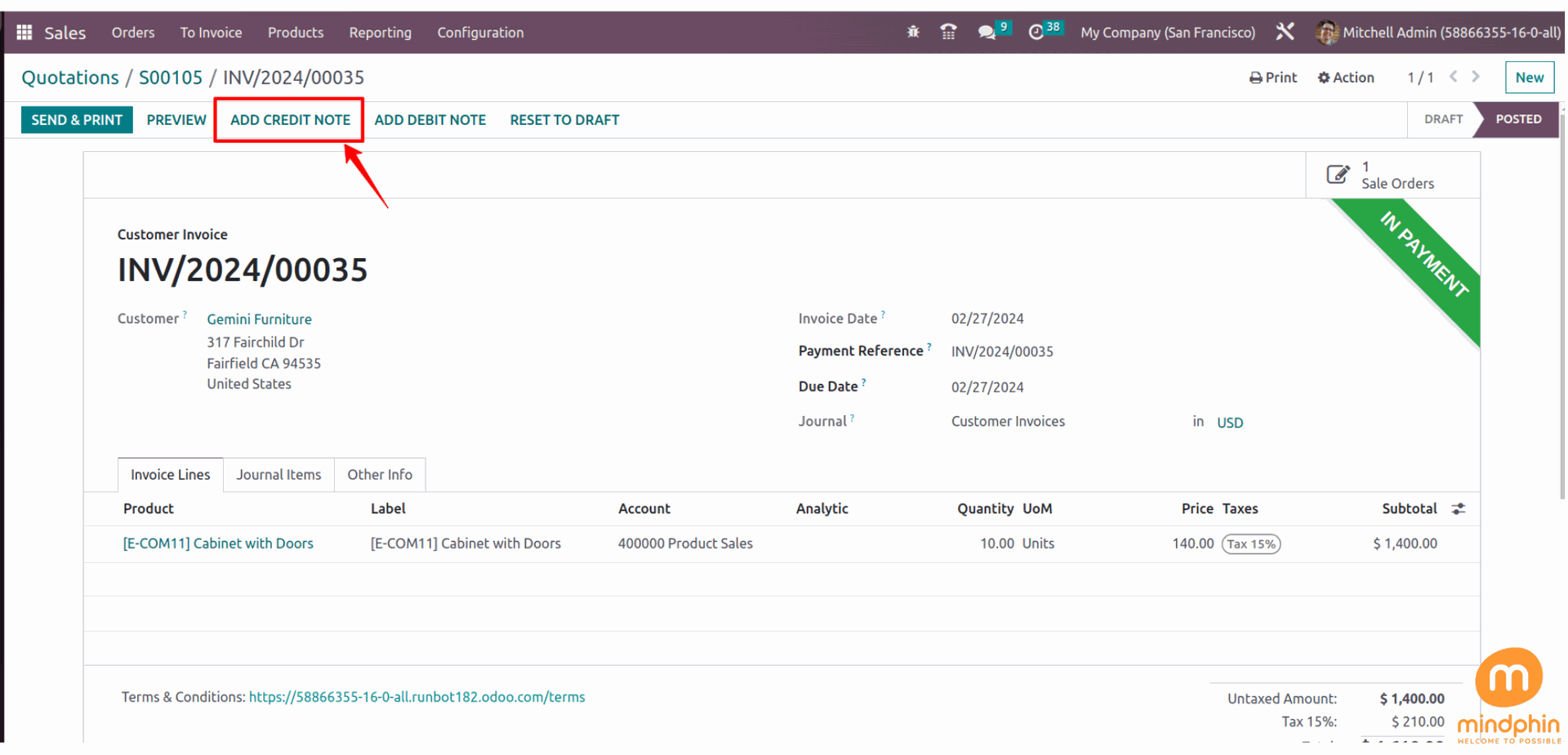

After adjusting the reversal journal entries in the stock journal, the company needs to reimburse the customer for the amount paid. This involves issuing a 'Credit Note'.

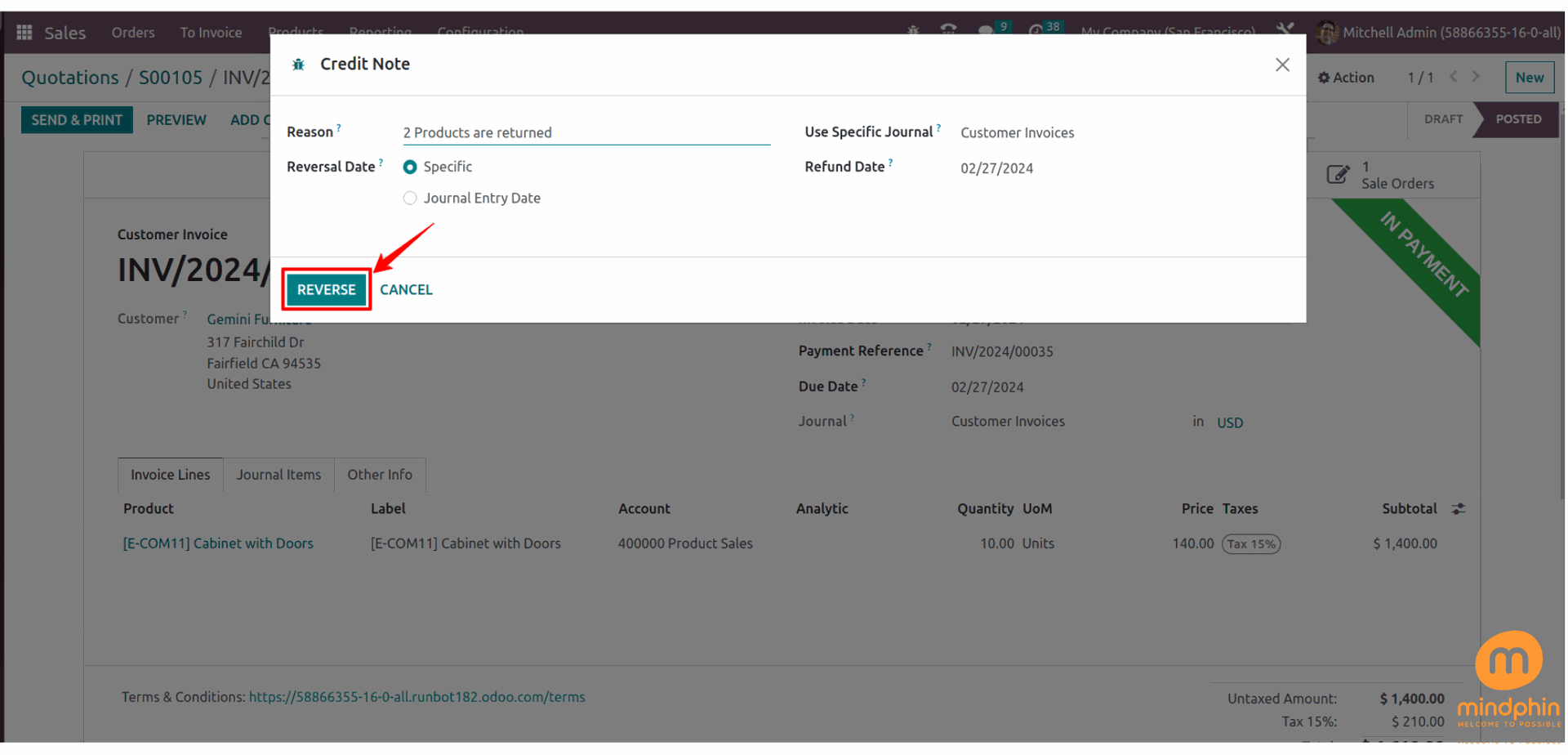

When you select ADD CREDIT NOTE, a pop-up will appear allowing you to input the reason for the credit note and generate a reverse invoice.

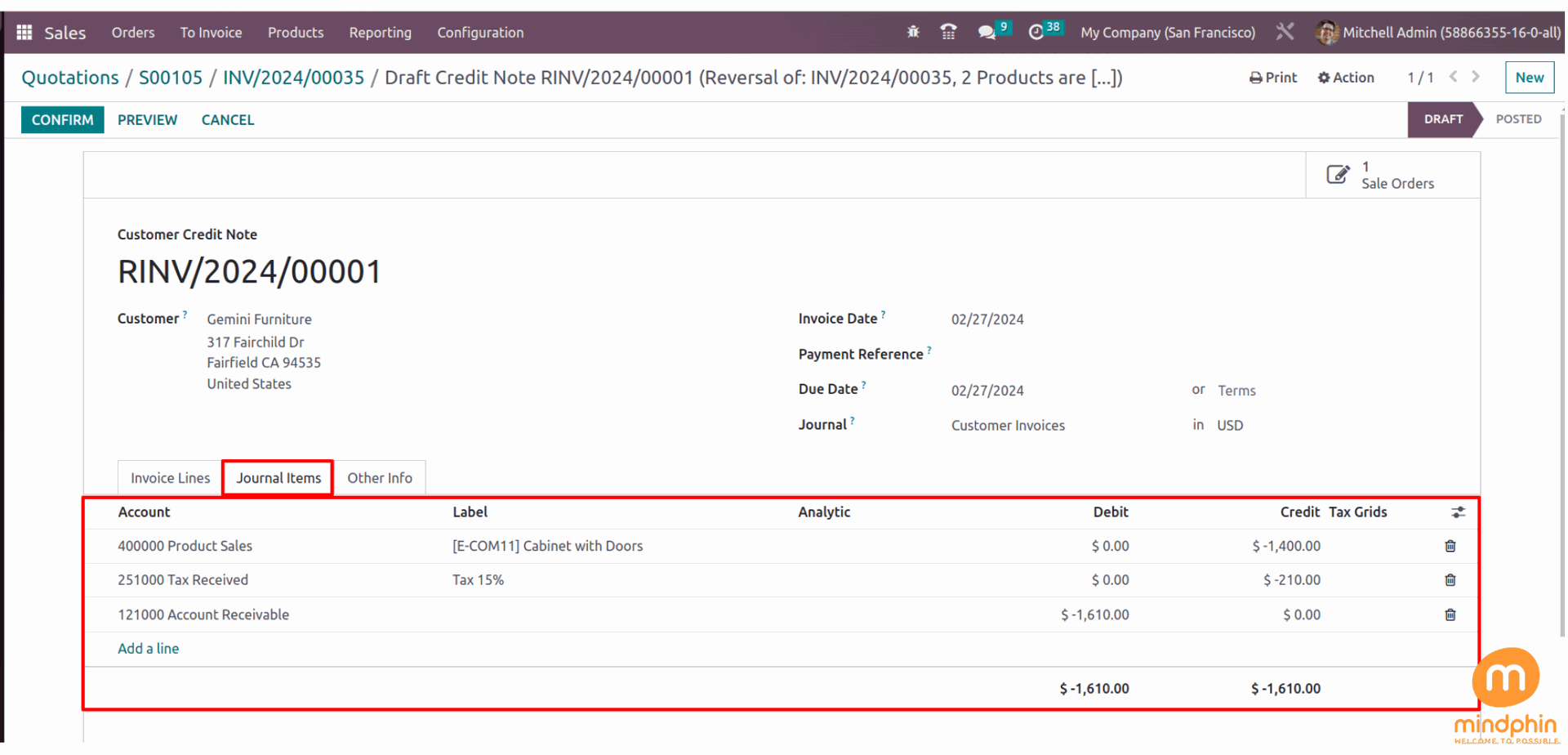

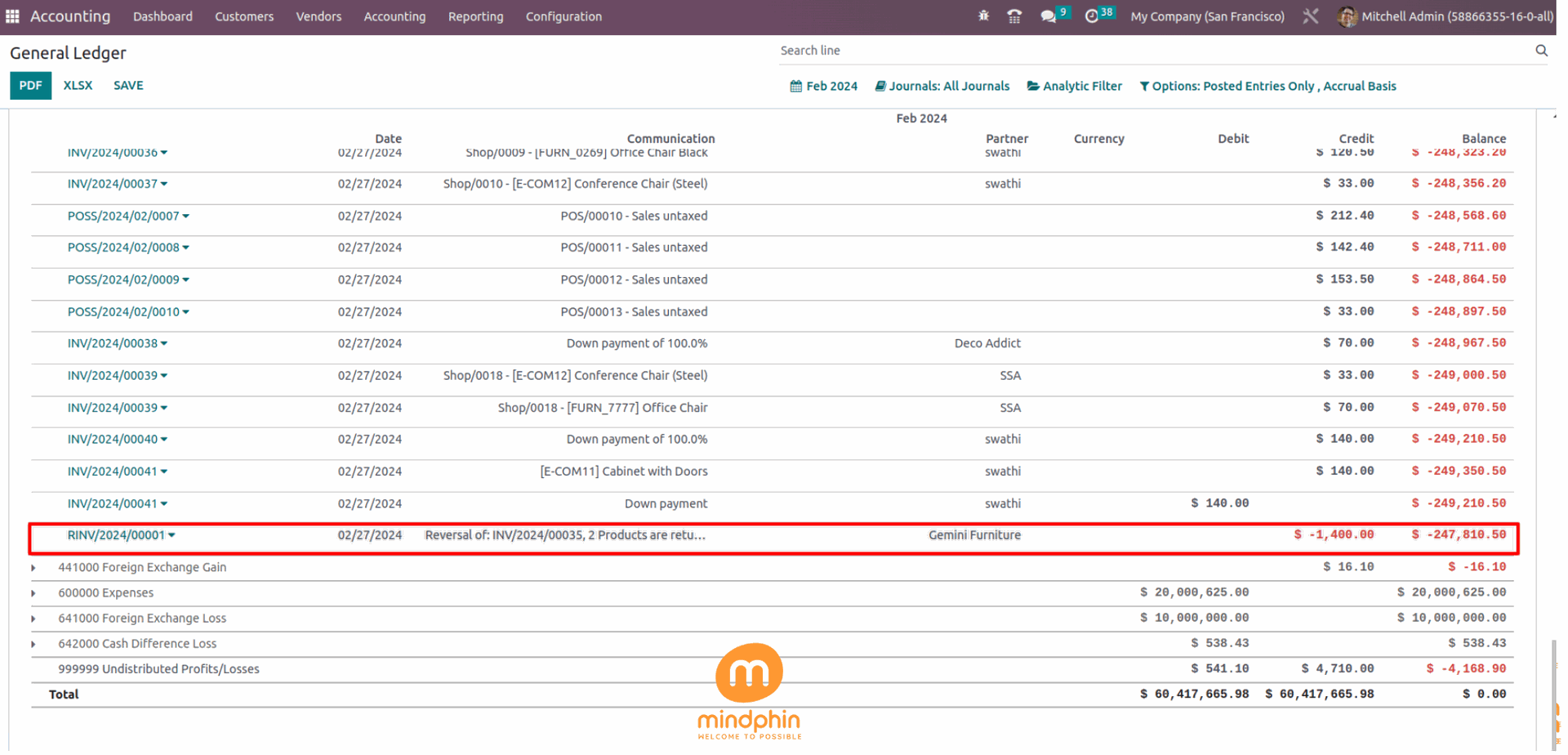

Now let’s check the ledger of the reverse invoice.

Here the income account is -(Credit) instead of debit and all others are depicted in negative.

When an invoice is created, Accounts Receivable are debited and Income Accounts are credited. Upon reversal, the Income Account is debited and Accounts Receivable is credited. However, in Storno accounting, Accounts Receivable is recorded as a negative debit and the Income Account as a negative credit for the reversal entry.

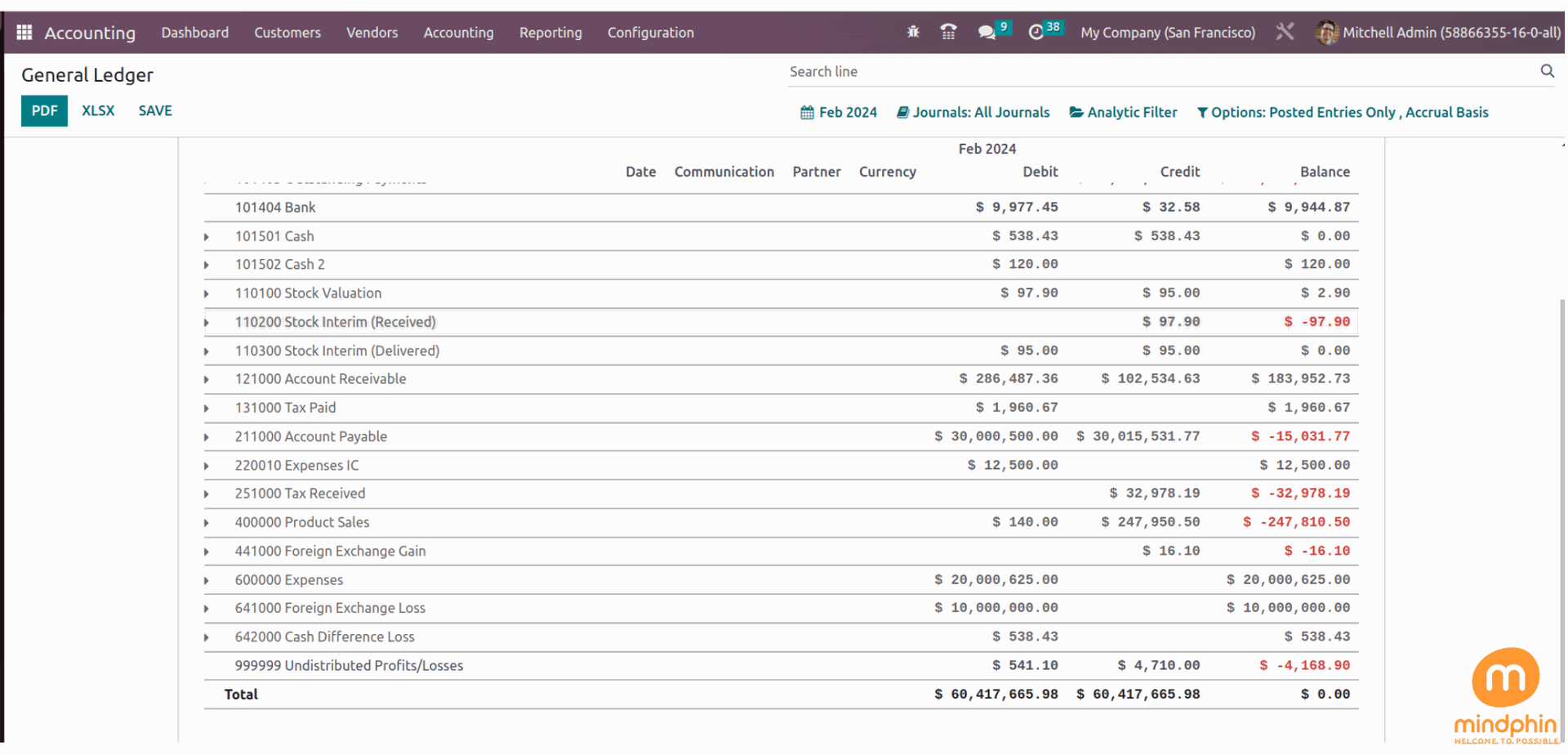

In addition, negative figures will be highlighted in red in the accounting reports. Access the general ledger report to view all balance amounts that are displayed in red due to being negative.

One can unfold the accounts and view the respective journal entries in each account.

Storno accounting is a method used by accountants to record reverse entries in a negative format, typically highlighted in red for easy identification.